Updated: Mar 7, 2022

Forcing English and Welsh students to pay nearly £10,000 a year towards their education is just the beginning.

One of the coldest on record, 1998 was a strange year. Boyzone (somehow) topped the charts with “No matter what they tellll us, no matter dooooo…”. Millions of English World Cup fans were left disappointed when England lost to Argentina… And for the first time, the Blair government introduced fees for students.

The £1,000 a year tuition fees put an end to free higher education in Wales and England forever, and introduced a government-backed loan for hopeful graduates. It was students’ first encounter with debt.

But the tuition fee system did more than that.

It repositioned the way businesses viewed students. Over the next decades, these young adults who studied hard and lived on shoestring budgets became nothing more than cash cows. Twenty-two years on and the average student debt will soon hit £50,800 (source: Institute for Financial Studies). All this financial pressure to shoulder, before they’ve even made their first salary.

Students are picking up the bill left by others

But here’s the thing… This is not their debt to pay. Students are picking up the bill left by expensive wars, a financial crisis, devastating recessions, and a pandemic that was badly handled. They’re burdened with a national debt which had nothing to do with them. A lot of it was created before they were even born and it’s not fair.

So why are they getting lumbered with all these payments? Well, my bet is elections. Students tend not to vote as much as other people. Because firstly, the minimum age is 18. So, loads of students will have already started term before they can register. Which further highlights how young and inexperienced they are with this stuff. And secondly, what kind of student prioritises politics over going out, getting grades, and getting laid? Like seriously, when you were a student, did you make any effort to vote?! Because I didn’t!

And so, because of that, governments can slyly offload the national debt onto students’ shoulders with minimum awareness or backlash. Imagine if they tried to shift all that tax onto retirees or middle-class households. That political party would be out the door and drowning their sorrows before the newspaper ink is even dry.

It’s a different story with students. If students are tarnished (probably by right-wing media) as “work shy”, “ignorant”, “spendaholics”… then nobody gets too upset when they need to “pay their way”, right?

The very people who impose £50,000+ of debt onto students, are the ones who went to university for free themselves. While benefitting from booming employment, cheaper living costs and affordable housing. Of course they had an easier life because of it. With that lack of debt, they could go on to buy a property, afford a wedding, have children and all those important milestones that Millennials and Gen-Zs are forced to delay. To be honest, if anyone should be paying a bit more to get us out of this debt… well… it shouldn’t be the unemployed students with an already bleak economic future, right?

Student housing is taking the piss

Ok so this is the bit that really gets me. Buckle in.

The average cost to rent an entire house in the UK is £181.75. Of course, it varies from region to region. Renting a home in the Northeast is the least expensive, coming in at £147 a week. Whereas in the pricey Southeast, the average rent for a house flies up to £283 weekly.

So that’s for a HOUSE. The average price to rent a ROOM in student housing – and let me be clear, it’s not a luxury room, and food is not included – is a MINDBLOWING £147 a week. A WEEK!!

In 1998, the cost of a room was around £50. Even factoring in inflation, this is an astronomical increase in price. Rooms have not improved. Far from it. They are just as cheap and shoddy as they were all those years ago. Still have those paper-thin walls, scratchy carpets and weird smells. In some cases, it’s exactly the same room as in 1998, beaten down by a few extra decades of wear and tear. Students are not richer now either. Their parents are much less likely to be able to help them out. But the prices do not stop rising.

So many of these properties are owned by greedy landlords and private equity companies, often based in off-shore havens. Blackrock is a big investor in student housing. Squeezing vulnerable young adults as hard as they can to make even more profit for their multi-millionaire clients. Disgusting.

Not super impressed with Blackrock to be honest, read more here.

Why is BNPL marketing so heavily to students?

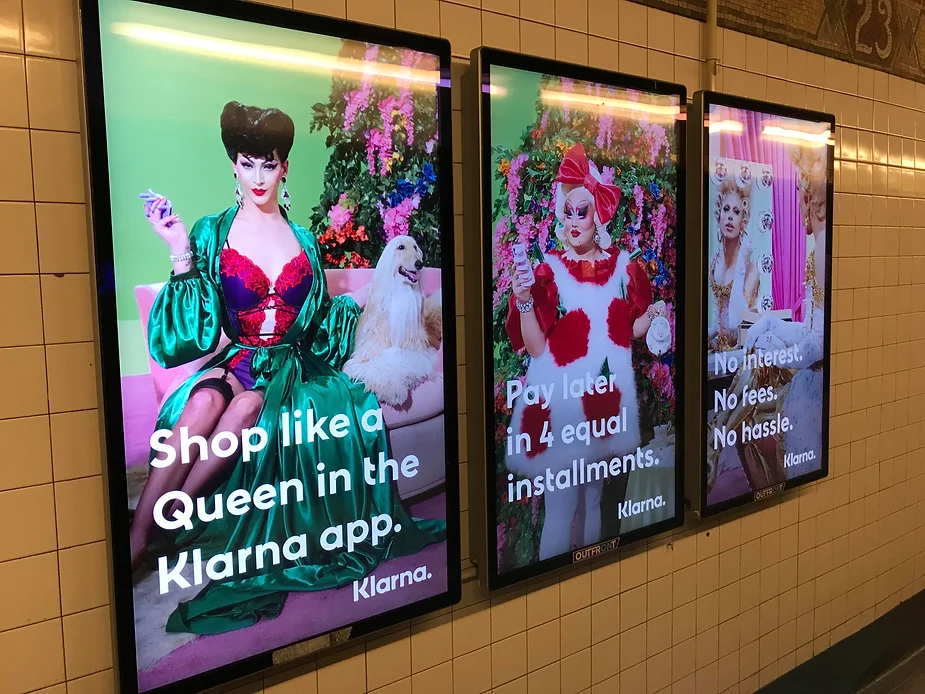

If the excessive debt from tuition and housing isn’t enough, students are now forced to battle their own psychology in a game of “Buy Now Pay Later”. Brands are really fighting hard to get students, vying for their attention with expensive “must-have” products. And then making the option of deferred payments excessively available. I’m not against BNPL, but I am when it’s being pushed onto students for things they don’t need and can’t afford.

Students live for the moment. We all know that. We all did it when we were younger too. To hell with the blisters, I drunk more shots out of my shoes than I probably wore them. (And I wore shoes every day). Young people are hard-wired to live fast and make stupid short-term decisions. Their pre-frontal cortex isn’t fully developed yet, and that prevents them from thinking much further ahead than next week. (Which explains all the mad cramming and all-nighters around exam time).

Let’s just say that at age 19, nobody is thinking about pensions. My sister is 18. And when I talk to her about my standard “invest for the future” articles, I can see her become so bored it’s like she actually hallucinates and watches an imaginary film about something else in front of my face. And it’s totally normal. She cares about what’s happening now.

Students like her also care about fitting into the group. Peer pressure is massive. So, what winds me up is when fashion companies and others play on this insecurity. When they blare pictures of attractive girls smothered in cheap garments all over Instagram. Like, sheesh, just leave these young people alone. They don’t need your tacky crop top. Shopping for fast fashion is not going to make them “Queens“. They need their own money and a bit of self-confidence.

We’ve got to stop this daylight robbery

We wouldn’t accept anyone taking advantage of elderly people and their money. So why is it happening to vulnerable young people, who have much less experience? Honestly, by the time they realise the debt they are in, it’s already too late. We have to talk about this.

The average UK student owes double what the average US student owes. Think about that. And look at the US. It has wealth gaps so gigantic, that they’re more like chasms. The divide is so massive it’s like asteroid hit the country and sent half of it flying to outer space, over to a whole new planet. Putting so much financial pressure on students doesn’t work. We must reverse the trend. Otherwise, we’re going to head in the same situation.

To investment managers, stop sucking up money from students. I mean it. What you’re doing is evil. That means student accommodation. Sh**ty fast fashion. All of it. These companies are taking up profit from people who need support. What’s more, as content creators like me continue to highlight this issue, the reputational risk could hurt the wallets of investors too.

And to anyone who has influence in politics or government… This might sound extreme given the current economy… But we need to wind down the cost of tuition. Over the next years, it must go back to manageable levels (I paid around £4,000 a year, something like that). My little brother just became a junior doctor. He’s cleaning more sh**, saving more lives and protecting more people than I could ever imagine … At night! He finishes at 8.30am. He’s 24. He worked nearly every night of the week to pay for his student living expenses over the past five years. And he’s nearly £100,000 in debt from student loans. It’s not ok.

It’s REALLY not ok.

This blog was inspired by my conversation with Laura Pomfret, who kindly invited me to join her “Things you shouldn’t say about money” podcast. If you’re interested in the whole conversation, you can watch it here! I’m episode 3, “Students are being screwed when it comes to money“.