Updated: Jul 14, 2022

Fossil fuel companies cannot scale-up without money. They need banks to invest in them or lend some cash. Of course, this is hugely profitable for banks and asset managers. But it’s also destroying the planet. So, the banks need to decide. Should they opt for the short-term profit, or the long-term planet?

Some banks are pretty shameless about going for the money. We all know that JP Morgan Chase, Barclays and HSBC ruthlessly pour capital into deforestation, fossil fuels, plastic and God knows what else.

Others go for sustainability. And boy do they talk about it! They are on every green board and panel out there. They have whole websites shouting about it. Entire departments raving about it. I’m talking heavy-hitting sustainability asset managers like BNP Paribas, Natixis and Blackrock.

But here’s the thing. Those slimy motherf***ers are still investing in fossil fuels!

They are having their dirty cake and eating it! I’ve done a bit of digging, and here’s some of the most jaw-dropping banking bullsh** out there…

1. BNP Paribas:

BNP Paribas really talk the talk.

Their whole website is a homage about how sustainable they *ahem* are. They’re

- “Committed to combating climate change” (some impressive alliteration there)

- “On the road to zero carbon”

- “Reducing impact and bringing employees together”.

Their website proudly proclaims;

“BNP Paribas has made the ecological and energy transition its top environmental priority as a global player that finances the energy sector. Our commitment aligns with the Paris agreement, which aims to make financial flows compatible with a low-carbon development”.

Powerful stuff. If it was true.

What do they really do?

However, according to a damning 2020 report, they’ve been happily handing money over for oil companies to chop down the Amazon rainforest for some time now. Local communities are left fighting for their way of life after their water sources were destroyed from oil spills, killing crops and causing sickness.

But it’s not just in the Amazon that BNP Paribas has been financing fossil fuels. Nope. They’ve gone global.

Despite their claims and marketing, BNP Paribas is Europe’s biggest fossil fuel bank.

According to the 2020 Banking on Climate Change report:

- BNP Paribas doubled its coal power finance over the past year

- BNP Paribas is the leading bank for oil and gas

- In 2019, BNP Paribas underwrote a staggering $30.6 billion for fossil fuels, nearly double the previous years

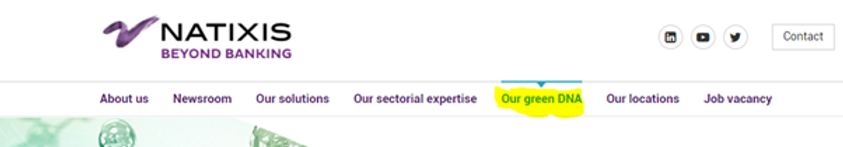

2. Natixis

Apparently, Natixis has ‘green’ in it’s DNA… Would that be a shade of petrol green by any chance?

Because, when you look at the hard facts, it’s seems that their favourite type of green is still the one that lines their wallets.

What do they really do?

According to data from Bank Track, some of Natixis’ dirtiest recent deals include:

- $15 billion of co-financing for a pipeline of gas to be built in Mozambique in 2020

- $120 million of debt to build the Dakota Access Pipeline to transport crude oil, between 2016 and 2019

- €635 million of debt to build the Trans Adriatic Pipeline for oil and gas extraction in 2018

- $473 million of debt to expand some sketchy mining in Guinea in 2016

- £650 million financing for Biomass Electric Power Generation in the UK in 2016

Natixis has some leading sustainability people on board, which is why these deals are so incredibly frustrating. Natixis are putting a lot of effort into the brown to green transition. They’re no longer financing coal, which is a great start. But I think they’re being deliberately naïve if they think that financing fossil fuels is going to help on the journey.

I’m not saying that we need a full-on anarchy. Of course, fossil fuels need to be phased out and replaced in an organised way.

But for f***s sake Natixis, stop financing new pipelines.

3. Blackrock

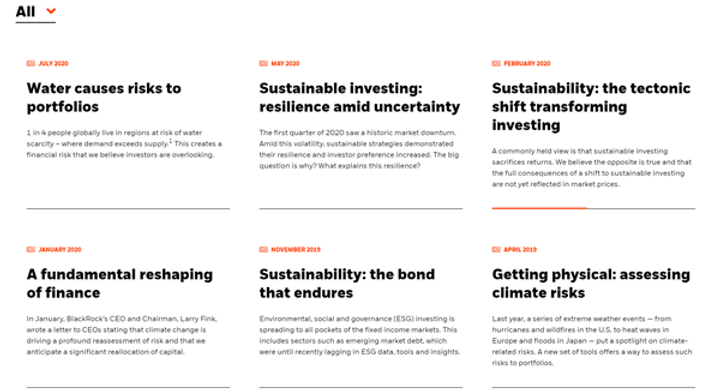

Oh mama. Blackrock have a lot to say about sustainability. Everyone remembers Larry Fink’s famous 2020 client letter. If you didn’t catch it, here’s a quote which sums up the whole thing rather well:

‘Where we have the greatest discretion – in portfolio construction, our active and alternatives platforms, and our approach to risk management – we will employ sustainability across our investment process’.

Letter to clients 2020, Blackrock

Blackrock seem to have a lot to teach us about sustainability too. On their website, they have a vast library of information to help us learn more.

But you know what they say, those who can’t do – teach.

Because Blackrock has not exactly been a grade-A student when it comes to their business deals.

What they do:

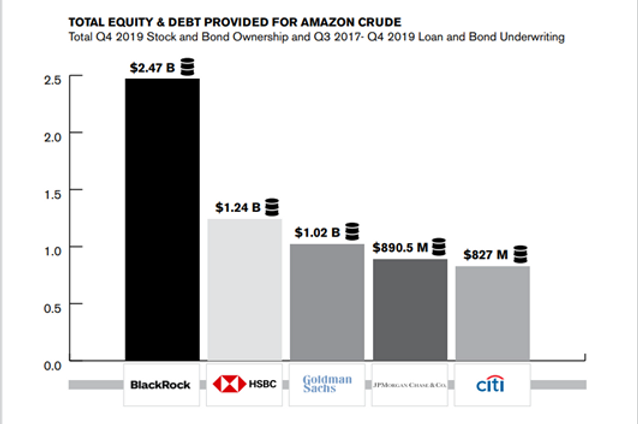

A 2020 report by AmazonWatch, ‘Investing in Crude Oil’ listed BlackRock as one of the top five dirtiest financiers.

The study reported:

“As of this writing, Blackrock has made no explicit commitment to shift capital from all of its climate-destabilising investments, including oil, gas and deforestation-risk soft commodity companies. Not has it committed to any indigenous rights policy that would hold the companies it invests in accountable to respecting and upholding internationally recognised rights to self-determination.

Indeed, BlackRock’s investments in Amazon crude oil continue to carry extensive levels of risk for the climate biodiversity, and indigenous peoples, not to mention BlackRock’s clients. As of (Q4)2019, BlackRock holds $2.5 billion of stocks and bonds in GeoPark, Frontera Energy and Andes Petroleum. BlackRock previously held a position in Amerisur as of (Q2) 2018, but sold it in late 2018”.

So, in a jaw-dropping act of hypocrisy, Blackrock continue to remain a leading player in fossil fuel financing.

But we’re not done. Oh no Sir.

- In March 2020, 32 horrified environmental organisations wrote to Blackrock asking to divest from the world’s largest wood-burning station Drax Plc. This charming UK-based company burns 14 tonnes of trees every year and emits 13 tonnes of carbon dioxide into the atmosphere … and Blackrock is its third largest shareholder.

- Blackrock are also a shareholder in Biomass, another huge UK wood-burning company. Thanks for that. Why have one when you can have two, right Blackrock?

- In September 2020, Blackrock became the unfortunate subject of a Friends of the Earth and Profundo report, ‘How the Big Three Asset Managers Enable Consumer Goods Companies to Destroy the World’s Forests’. The report shows how the asset manager has $157 billion invested in companies which deal in things like palm oil, soy, cattle and paper. It directly enables companies to tear down rainforests and pump carbon into our atmosphere.

It’s really sh***ty that Blackrock finances these things. It’s killing our planet, and screwing up our weather.

I could go on and I probably will later. These three banks were picked at random. There are at least ten more banks I can add here, and a bunch more shady deals. But this article is getting a bit long. So here’s the point:

The point I’m making…

Big banks and asset managers can invest billions into sustainability, but when they continue to finance fossil fuels, it means nothing.

On a personal note…

As I was writing this, my heart sank a bit. Because I know people in these companies who dedicate their life to green and sustainable finance. They are the best in the business. The best in the world. Some of the kindest and most passionately sustainable people I’ve ever encountered. So I don’t want to hurt their feelings. But their planet-saving effort and work means nothing when another department is still trading oil.

I used to work in one of these banks. I wrote award pitches. Really good ones. They all won. And it never struck me as odd that we’d win an award for green energy and another for oil derivatives in the same season. I’d put the trophies next to each other in the foyer and thought nothing of it. How f**king stupid is that? And twisted. We’ve got to wake up to the reality. We cannot call ourselves sustainable if we’re building new oil pipelines and cutting down forests. Us finance people need a reality check.

First and foremost, we need to stop bulls***ting ourselves.

These views are my own. They are my opinions, based on the available data and reports. I selected these companies because they promote themselves as sustainable, and it is therefore in the public interest to show the other side of their dealings.