Updated: Mar 7, 2022

Browsing the latest trends online is part of everyday life for 20-year-old student Lauren. Like thousands before her, she feels the pressure to fit in and look good around university. But unlike any previous generation, Lauren can make instant purchases with money she doesn’t have. As increasingly worried experts, regulators and psychiatrists call for tighter Buy Now Pay Later (BNPL) measures, could it already be too late for 45%[1] of Britain’s young adults?

“Good at making it emotional”

Young people are relentlessly targeted by BNPL schemes on Facebook, Instagram and Twitter. Psychologically, the combination of social media peer pressure and easy access to new looks can be extra difficult for under-25s to resist. According to Elin Helander, a cognitive scientist and chief science officer at Dreams, a financial wellbeing platform, some of the marketing tactics used by BNPL platforms are below the belt.

Helander talks about how social media campaigns can play on young people’s natural tendency to dismiss long-term consequences. “The pre-frontal cortex is not fully developed until the age of around 25”, Helander explains. “And most of what the pre-frontal cortex does is plan and execute for the future”.

“BNPL schemes are really good at making it emotional”, she elaborates. “Younger people are more likely to suffer from peer pressure. The driving force of fitting in and belonging to a group is much stronger than the driving force to have a good financial situation”.

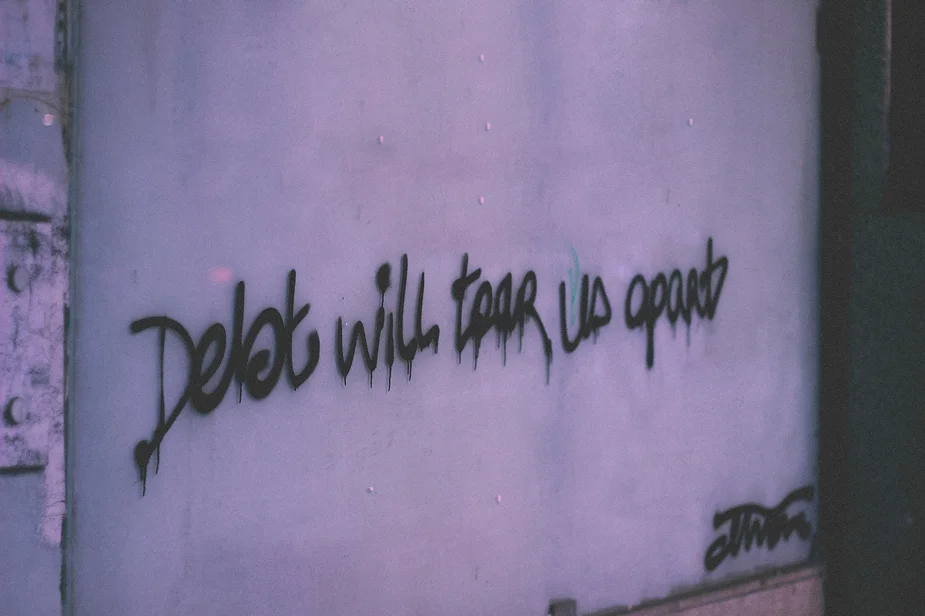

For Lauren, the “pressure to look good around campus” was the motivation behind her purchases. Like the majority of BNPL users in her age group, she owes around £200 and will carry the debt for several months. “It can build up so quickly that if you don’t keep track it can be dangerous”, she reveals.

“Fail to mention how debt collectors can get involved”

Lauren – who studies psychology – believes BNPL schemes “definitely” coax shoppers into spending more. “It’s a trick in itself to promise people an interest-free way of delaying a payment with no real restrictions on the usage of the platform”, she explains. “They fail to mention how debt collectors can get involved”.

And debt collectors are increasingly getting involved as shoppers default on payments. BNPL got a boost during the COVID-19 pandemic as cash-strapped shoppers were attracted to the service due to the ease of making part-payments for products they bought online or at stores, without additional costs or fees.

But now, 41% of BNPL users are struggling to meet their repayments[2], and for 18–34-year-olds this rises to over half. “A lot of young people are using BNPL, and a significant portion are experiencing real difficulties with it”, reveals Gemma Byrne, a senior policy researcher for Citizen’s Advice, a British legal advice charity.

Stagnant wages and rising living costs only add to the problem. “Over the last ten years, the age of clients we’re seeing has got younger and younger”, reveals Peter Tutton, Head of policy research and public affairs at debt charity StepChange. “Younger adults are more likely to have high housing costs, low paid work and insecure incomes”.

In Tutton’s experience, BNPL can be a gateway to more debt. “The frictionless of it makes it very easy for people to use credit” he elaborates. “Then the temptation is to juggle credit, and so it spirals onwards and upwards”. 54% of people facing debt collectors for BNPL purchases take out more debt to pay it off[3].

“So frictionless its almost slippery”

For many BNPL fans, the frictionless journey is a huge plus, as they can get the instant gratification of shopping, with none of hassle. “I love how easy it is to use”, says 19-year-old holiday park employee Sam. “If you’re on a budget at any given time you’re able to get the products you want or need very easily.”

BNPL is so easy to use that some people don’t realise they’ve signed up. This was the experience of Liz, an anonymous respondent to the Citizen’s Advice research published in September.

“I really don’t understand how I ended up paying for my plants through BNPL”, she told Citizen’s Advice[4]. “I didn’t understand what it was… And then I got a letter from a debt collector”. Liz is not alone. 40% of the people who use BNPL do so by accident[5]. “The product design of BNPL is so frictionless it’s almost slippery”, stresses Byrne.

But when it comes to finding out more or getting out of debt, it’s not so straightforward. “We refer to this as nudge and sludge”, Byrne reveals. “A sophisticated set of nudges to get people to do things very quickly. And then the sludge comes in when you try to find out more information or get help … A financial quicksand”. 30% of BNPL users found themselves with a fee that they were not expecting[6]. For many it was because they were unable to contact the provider or get the information they needed.

Byrne was keen to stress that BNPL doesn’t always affect customers’ credit scores. However, in some cases it can damage scores, especially when debt collectors get involved. “If this happens, it could affect your ability to take out a loan, and that could include a mortgage or business loan”, Byrne elaborates. For young people, life milestones could become out of reach.

This has already been the case in the US, where 72%[7] of people who fell behind on repayments saw it on their credit score. Predictably, it was the Gen-Zs and Millennials who were hardest hit, with more than half already missing at least one payment. Yet, BNPL shows no sign of slowing.

BNPL expansion plans

Recently, Australian BNPL lender Zip acquired Payflex, with a view to expand into Africa. While this offers many opportunities, if BNPL remains unregulated, it could pull more young people into debt.

BNPL is spreading to low-income nations where Gen-Zs and Millennials could become destitute. “[BNPL] has moved into developing countries,” an anonymous BNPL expert and investor reveals. As the market is still small, and this whistle-blower is a key player, he prefers to remain unidentified to avoid reputational damage. “And some of the newer providers are dubious. They will lend to anyone as long as they can make a quick buck”, he comments.

Because most BNPL providers make their money from the merchant and not the shopper, there’s an incentive for them to appear in as many shops as possible, already featuring in more than 20,000[8] checkouts, according to a report by Bain.

There’s a benefit for merchants too. Simply seeing BNPL options can trigger customers into spending more. And for smaller merchants, offering BNPL solutions at the checkout boosts their perceived credibility[9].

Over the past year, the UK BNPL market has been unregulated. This meant that some compulsive shoppers, like Diana who has bipolar disorder[10], surged into debt effortlessly.

For the experts, the UK’s recent legislation is a welcome addition. But more friction and information are needed to ensure the BNPL trend is a positive one. “Other types of credit have rules about adequate explanations”, explains Tutton. “The question will be how detailed they get for BNPL. If you make it too onerous, you collapse the market. If it’s not onerous enough, you get lots of people getting into trouble”.

We need to rein this in.

What’s happening to our young people and students is not fair. They’re being treated as never-ending cash cows. Each new generation of vulnerable, credit-free young adults replacing the next, in a disturbing cycle. We need more friction, more protection and less emotive marketing. For God’s sake. Our young adults need support, not more debt.

Read more about how students are being taken advantage of