Updated: Sep 13, 2021

Sustainable investors beware! BP may seem like a greener company nowadays, and it features on hundreds of ESG funds. But I believe it is all smoke and mirrors. Like all evil geniuses, BP seem to have a game plan. A playbook for how to appear much greener than they truly are.

Here are nine slippery tactics behind BP’s greenwashing:

1. Shift the attention

Have you ever felt guilty about your carbon footprint? You may have thought that this guilt stems from something deep within your soul. But amazingly, the “carbon footprint” was a marketing ploy from none other than evil genius, British Petroleum[1] or as they’re called nowadays, BP.

In 2004, BP hired PR firm Ogilvy & Mather to create the mother of all scapegoat campaigns. And good lord, they went for it. To distract attention away from BP, the ad gurus cleverly dumped all the blame on us, the powerless consumer. The “carbon calculator” was born. The guilt began. We stopped blaming corporations and started blaming ourselves.

Of course, BP carried on draining the world of fossil fuels and pumping out carbon for profit. In 2004, CEO Lord Browne awarded himself an 18% pay rise, bringing his annual salary up to £4.8 million[2]. Since 1965 the company has emitted 34.02 billion tonnes of carbon. To put that into perspective, the entire UK emitted 351.5 million tonnes of carbon in 2019[3], just over 1% of BP. So, I think it’s clear where BP can shove it’s carbon calculator. And it’s guilt.

2. Invest $3.6 billion in green marketing

If you look on BP’s website today, you could be fooled into thinking all that’s in the past now. That BP are really trying to go green. The whole site is a homage to green renewable and sustainable energy… or sorry, no “alterative energy” they call it. The reason for this might have something to do with the $3.6 billion[4] the company has spent trying to green-up it’s image.

I could hardly find a single word about oil anywhere. Strange for a company whose name was British Petroleum, right? And even stranger for a company whose MAIN PRODUCT IS STILL OIL. Their teams are drilling new sites as I type. That $3.6 billion is really doing it’s job, you would hardly know it’s BP.

In addition, BP are spending upwards of $2 million a year on Facebook and Instagram adverts to sway the opinions of younger people. Sneaky.

3. Put your real activity in small print … Shhhhh…

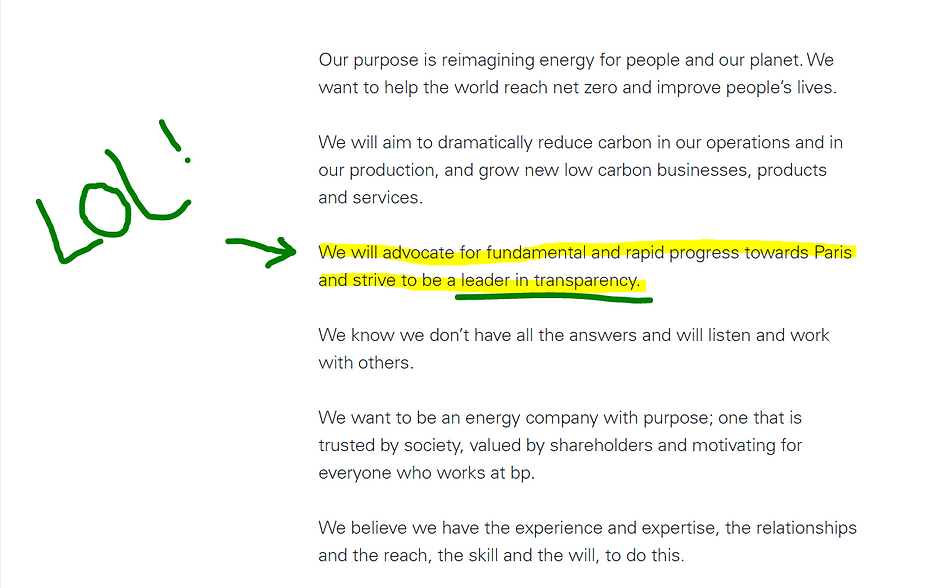

This is why I think BP is evil. Because the people in charge … they know that what they’re doing is not ok, but instead of confronting it honestly, (and despite their aim of being “transparent”) they hide it.

They hide it, for example in the investor reports. But here, let me put it in big print for everyone….

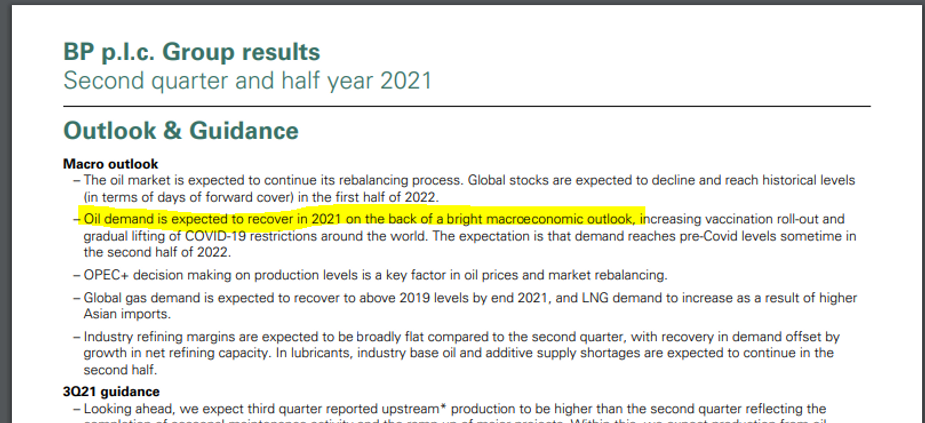

Check this out: “Oil demand is expected to recover in 2021 on the back of a bright economic outlook”, they reveal in small print to investors. “The expectation is that demand reaches pre-COVID levels sometime in the second half of 2022”.

Bright economic outlook?! For drilling new oil!? Are you f**king serious, BP?

Source: BP Q2 2021 Results

Because we all thought your purpose was supposed to be, “Reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives”. That’s what BP proclaim in the very metadata of it’s website. But clearly, it’s just semantics.

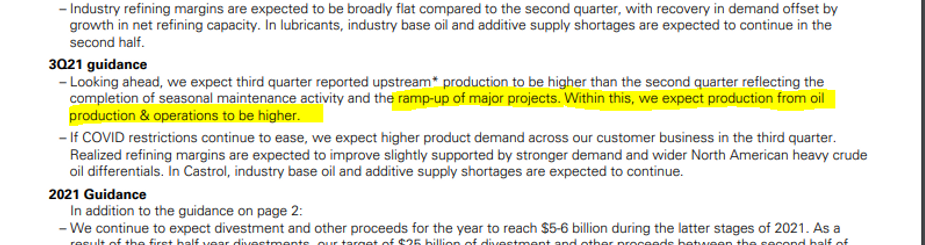

BP has no plans to truly scale back oil, it’s most profitable commodity, whispering in the back of the investor documents, “Looking ahead, we expect third quarter reported upstream production to be higher than the second quarter reflecting the completion of seasonal maintenance activity and the ramp-up of major projects. Within this, we expect production from oil production & operations to be higher”.

Source: BP Q2 2021 Results

So, BP’s oil drilling expeditions are up, and it predicts a bright future for oil. But the finance guys will only breathe this to investors – probably with a wink and a nudge – in drab documents. Because it’s nowhere to be found in BP’s flashy marketing material or website.

BP says that it advocates transparency, but how can this be true when it’s most scandalous plans to scale-up oil production are hidden behind huge green marketing campaigns?

4. Invest just enough in renewables that it seems plausible

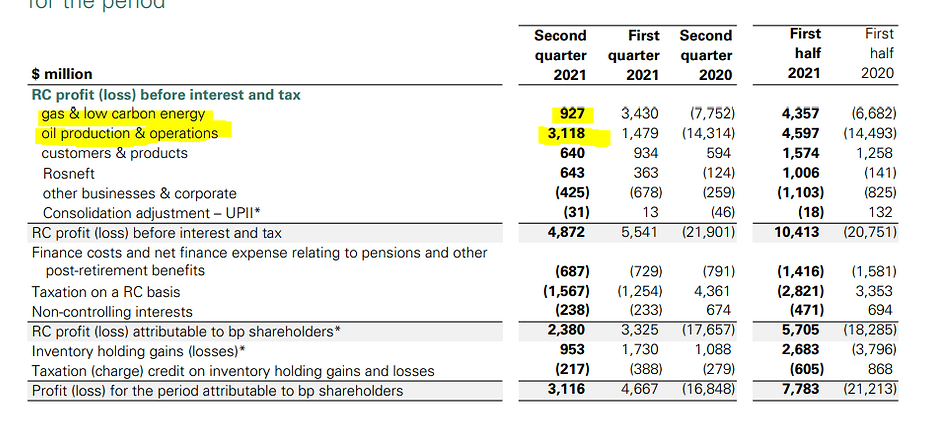

The first point to make is that BP lumps natural gas (non-renewable) and low carbon energy (which doesn’t necessarily mean renewable) together when reporting. Which is already quite suspect. Gas is carbon-intensive after all.

Perhaps the reason they do this, is so they can say that their Q2 2021 profit for “gas & low carbon energy” was a respectable $927 million. Which sounds like a lot… Although it’s still dwarfed by the $3+ billion profit of their oil production.

Source: BP Q2 2021 Results

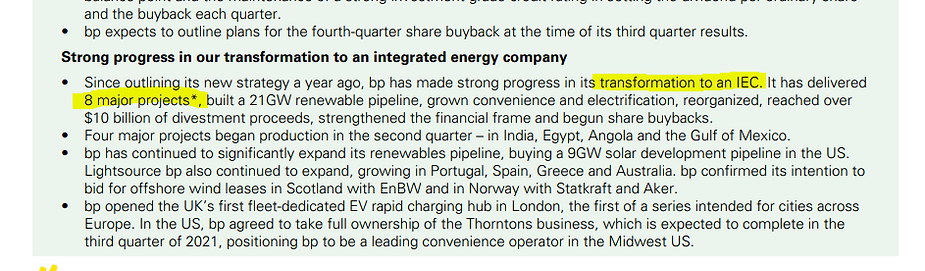

But actually, when we dig a little deeper, we can see that their renewable projects are very slim. So much so, that they’ve only applied to become an Integrated Energy Company in 2020. Which begs the question… what the hell was BP doing in our ESG funds for all the years before?!

At the time of writing, BP have delivered just eight non-oil energy projects since their application, which include gas pipelines – not renewable at all.

Source: BP Q2 2021 Results

Sure, BP have designs on off-shore windfarms and it’s planning to buy a few renewable plants here and there… but at the end of the day it’s just a drop in the ocean. I’m not buying it. (Well, sadly I am, because of my f***ing pension. More on that below).

5. Take more than twice as long as other energy companies… and still don’t do it

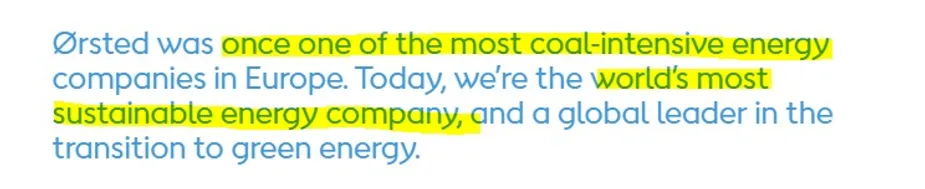

It took rival energy producer Osted just under ten years to transform into a green company. Today Osted is the most sustainable company in the world. You know why? Because the people in charge actually tried to do it. They didn’t greenwash, they just got on with the job.

Source: Osted

BP, by contrast, have been paying a lot more lip service – while scaling up planet-destroying oil drilling – for over two decades. It’s a joke. If BP was truly serious, the process surely would have already been well underway by now as the company has significantly more money and resources than Osted. But BP is using money to drill new sites and buy green marketing instead. Like, what the hell!?

6. Continue expanding oil on the down-low

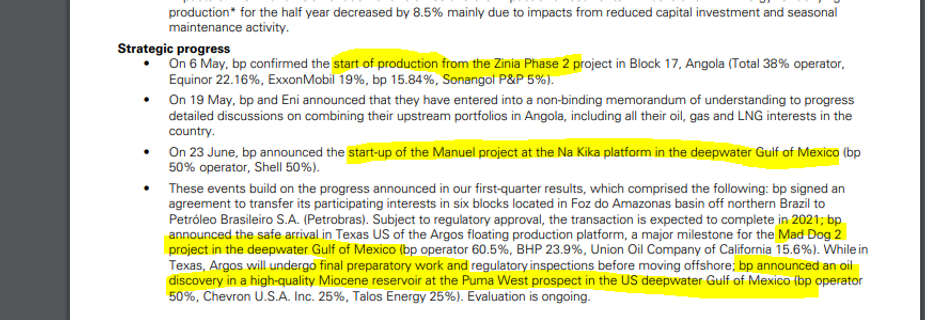

In the past couple of months alone, BP have embarked on a series of new fossil fuel expansions.

On the 23rd June BP and Shell began a new oil project, known as the Manuel Project in the deep water Gulf of Mexico – not too far from the notorious oil spill. One month previously, on the 6th of May, BP confirmed the start of a new oil production project, known as Zinia Phase 2, Block 17. The slimy company has also recently announced a new oil discovery, again, in the Gulf of Mexico which they plan to drill.

There are many more, but you get the point… Just read the teeny tiny blocks of dense and boring writing in their investment documents to get the full picture[5]. BP are not scaling back.

Their sustainable marketing counts for nothing. BP? What a load of BS.

Source: BP Q2 2021 Results

7. Spend $50 million pressuring government against climate change legislation

And if you need further proof – as if the deceptive marketing tactics and oil expansion were not enough – just check out how much money BP put towards lobbying anti-climate change regulation.

Together, the top five oil tycoons spend nearly $200 million[6] each year blocking climate change policies. BP is the very worst, paying up more than $50 million. Pretty disgusting, right?

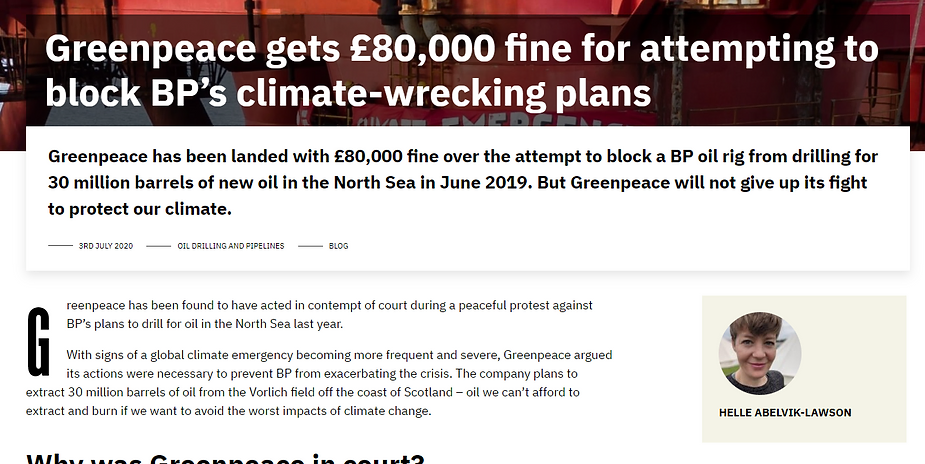

8. Try to dismantle Greenpeace

Not only that, but BP is also suing Greenpeace left, right and centre. Back in 1997[7], it was revealed that BP intended to shut down the NGO – who publicly protests the oil tycoon – by bankrupting them.

Today, the oil tycoon is still up to old tricks. 23 years later, Greenpeace are still facing bankruptcy threats from BP, and recently had to shell out another £80,000 [8] after protesting the drilling of a new oil rig in breach of court orders.

9. Misrepresent carbon reductions

In it’s 2020 annual report, BP seem to present a 9% reduction in carbon emissions as some kind of a sustainable win… When everybody knows that this is because the world locked down last year.

It’s like everything is just twisted, and what continues to surprise me is how often I fall for it. Their documents, words, marketing, it all looks so compelling. I must keep reminding myself again and again that these are the same people blaming individuals, lobbying government, suing Greenpeace and expanding their oil operations. £3.6 billion buys you some f**king brilliant marketing. Enough to make even the oiliest operations seem environmentally friendly. It’s a real mindf***.

To sum up… This is greenwashing.

Greenwashing on a scale so enormous that it’s hard to fully comprehend. BP feels too large to challenge*. But somebody must. And, for my money, I want that somebody to be a fund manager. I want a fund manager with massive balls to step up and say no. No, BP cannot have the money earmarked for sustainable infrastructure. No, BP does not belong in our pensions. And no, BP is definitely not a green company.

Doing a little good here and there does not excuse the unimaginable damage they inflict every day.

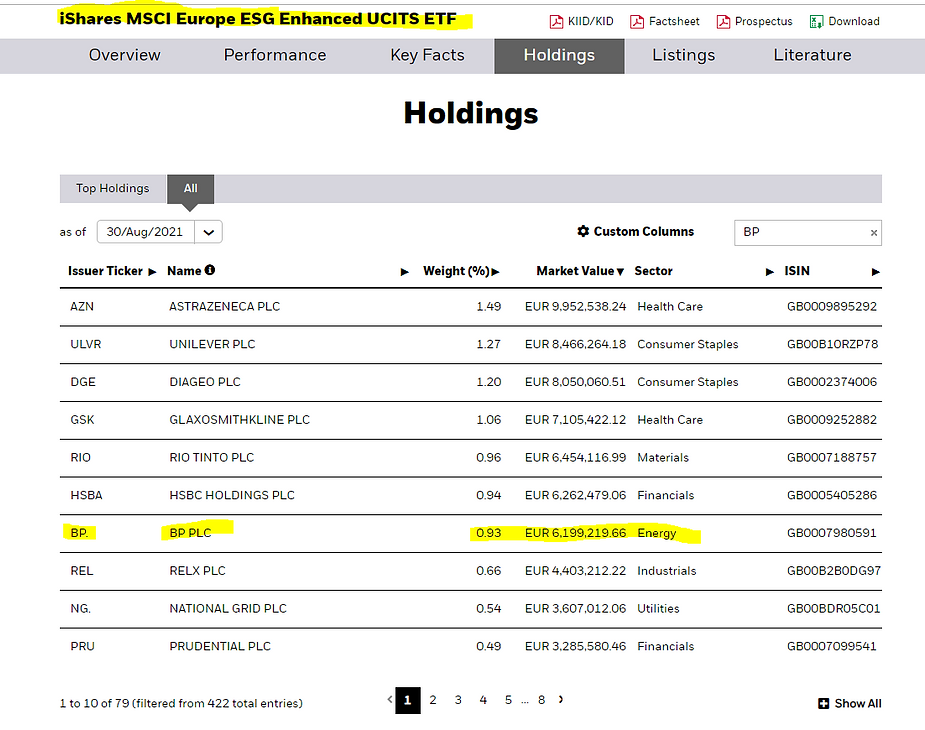

It’s a relief to see that finally MSCI removed BP from their Europe ESG Enhanced EFT this September 2021 (like just over a week ago). Quite right! But in August and all the years before, the slippery oil tycoon was there, soaking up a whooping 0.93% of the inflows – an amount equivalent to over €6 million. Bearing in mind that this fund is supposed to be the crème de la crème of sustainable investments, the cream of the green… it’s truly shocking that BP was ever there at all.

Source: iShares MSCI Europe ESG Enhanced UCITS ETF

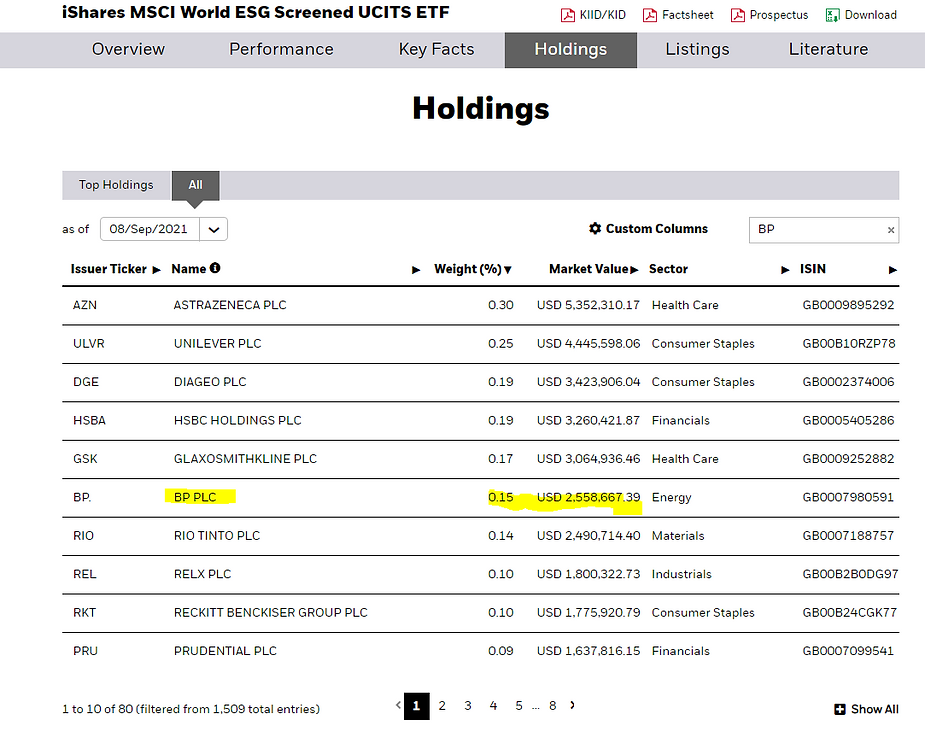

What’s more, BP still features on other ESG funds. For example, the MSCI Europe Screened UCITs ETF still contains BP. The company is collecting 0.78% of the money, which comes to nearly €9 million. And it’s also on the MSCI World ESG Screened UCITs ETF too, taking up 0.15% of the funds – or over $2.5 million.

Source: iShares MSCI World ESG Screened UCITS ETF

BP feature in a great many European ESG funds. It’s crazy difficult to get a full picture of the exact number. However, across the sample I reviewed, BP just kept appearing, lurking in the depths … normally hidden around page 8 of the holdings.

Globally, I asked my insider source (who as yet does not have a code name!) how frequently BP appears in funds. I was informed that of the 3,000 funds with ESG characteristics tracked by Morningstar, several hundred report a position in BP. Yikes. It comes to roughly around 10%.

What I’m certain of is that all of us, whether we like it or not, are probably putting money into BP somewhere. Including me. Through our pensions or our investments, or simply our savings accounts (especially if you’re with HSBC or Barclays – am I right!?) we are paying to destroy our own planet. And we are being misled about it. Our sustainable pensions are a dodgy shade of petrol green.

So, here’s my final takeaway, and I’m speaking directly to banks, fund, and investment managers (come on guys, I know some of you read my blog!!) …

Please exclude BP from ESG funds and products. Please use your power and influence to re-direct money to genuinely sustainable energy infrastructure. If BP cared so much about the planet, they would have transitioned years ago, like Osted. If they wanted green and sustainable futures, they wouldn’t be blocking climate legislation, or suing Greenpeace. And most of all, they wouldn’t be shifting the focus constantly away from their own practices.

If you need someone to help you write a strongly-worded letter, talk to me.

It’s not just BP. Here are four more evil genius companies lurking in your sustainable investments

* To be honest, I feel a bit nervous putting this into writing, because my scrappy law degree will not hold up against BP’s giant legal teams if they sue me. If BP took offence to this and wanted to crush me, they probably could. But we have to take a stand against greenwashing when we see it, right? Our planet is at stake. And if just one fund manager reads this and removes BP from just one fund… well, that’s millions of pounds which will be taken away from BP. So it’s worth the risk.

These views are my own. But they’re completely backed by days of evidence and research, and I’ve listed all the sources here. This blog is totally impartial. I don’t make any money from writing it and I don’t want to. I write the truth as I see it, and try to call out green washers when I think they are tricking investors.