Updated: Jun 9, 2021

Is there anything so villainous as a sin stock making its way onto an ethical fund?

If you imagined that Environmental, Social and Governance (ESG) funds were all about clean energy, zero carbon or sustainable earth-loving organisations, think again. The interpretation of “ethical” is so incredibly broad that even the most blatant planet-destroying corporations can talk their way in. From appointing women on the board of directors (… thanks?), to promising to reduce emissions thirty years from now, some baddies have sneaked aboard incognito. To add insult to injury, you can also find them in notorious vice funds too.

What is a Vice Fund?

Vice funds sound a bit evil, because they can be. The nemesis of ethical investing, vice funds put money into things like gambling, weaponry, pornography, addictive substances and fossil fuel polluters.

Here are five companies which can be found on both ESG funds and Vice funds at the same time. If you have an ethical investment portfolio – such as a ready-made sustainable Stocks and Shares ISA, it’s likely that you’ll be paying into some or all of these questionable corporations.

1. British American Tobacco

Yes, you read that correctly. In the U.S. alone smoking accounts for over 480,000 deaths each year[1], and immeasurable illnesses. It shortens lives by more than 10 years and 41, 284 unlucky people die each year from second-hand smoking[2]. Addictive, expensive and health-destroying – smoking is bad right?

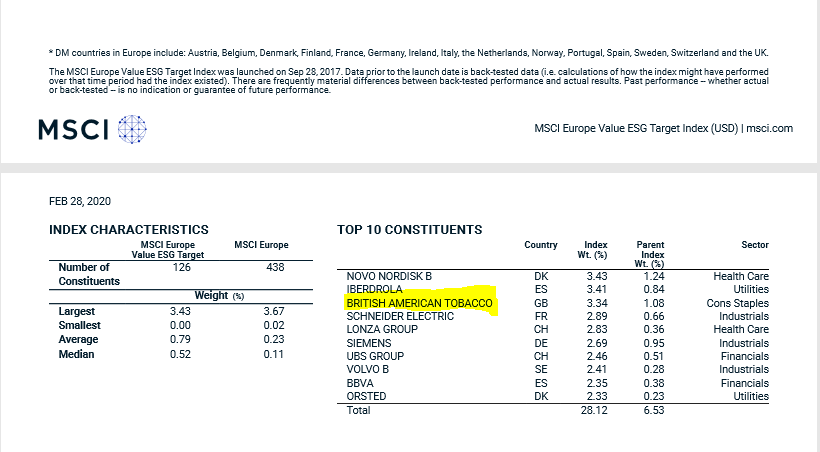

Not according to the MSCI who have included British American Tobacco (BAT) across several of their ESG funds. Despite being one of the largest cigarette manufacturers in the world, with more than 16 brands, BAT is promising to reduce its health impact on the world. They’ve been upping their vape game and working on reducing the “riskiness” of their products. Somehow this was enough and now they are in. It’s not widely advocated, but British American Tobacco made the cut.

You can find it tucked away in ethical ESG funds and indices, such as here in the MSCI Europe ESG Value Target Index.

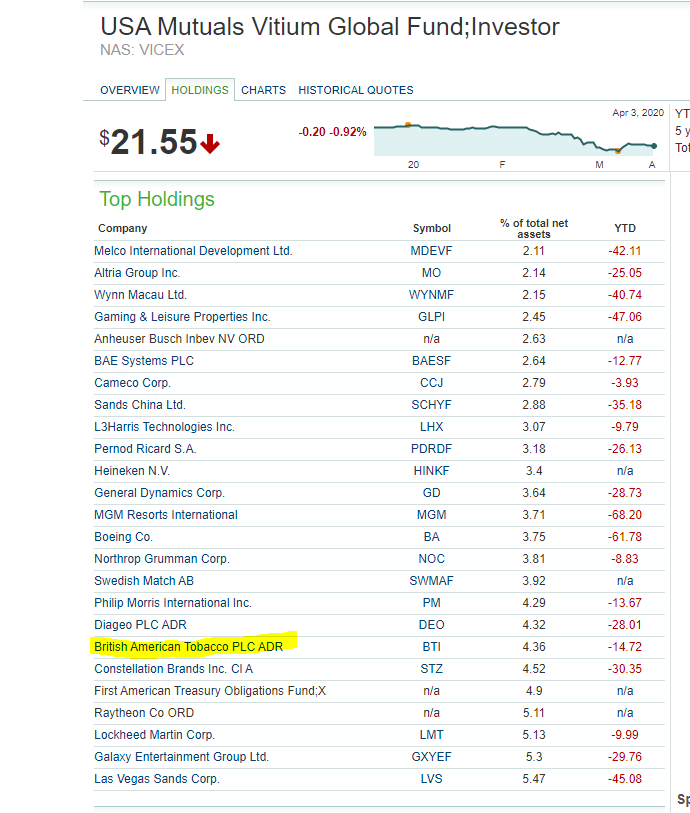

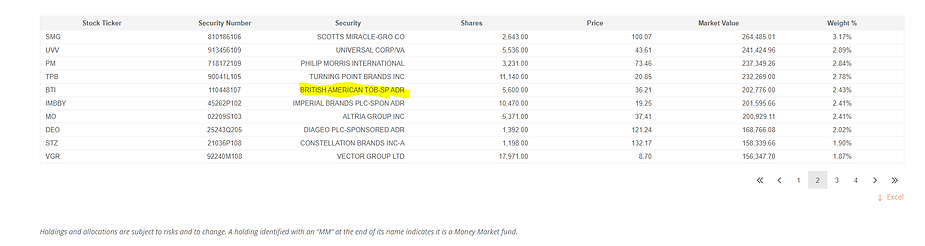

As you may expect, British American Tobacco is a prominent player in Vice funds too. One of the most infamous bad-guy funds is USA Mutuals Vitium Global. Sure enough, nestled between casinos and alcohol, you can find this tobacco tycoon– currently enjoying just over 4% of the assets.

Another sin stock daddy is AdvisorShares Vice ETF – which is even bold enough to have “vice” in the name, just so you know they’re super serious about being sinful. British American Tobacco is right there with the best of the baddies.

2. Coca-Cola

Who doesn’t enjoy a coke? This characteristically American beverage symbolises an age of youth, freedom and it goes great with rum. Unfortunately, it also goes well with weight gain, caffeine addiction, fatty liver disease, insulin resistance, type 2 diabetes, leptin resistance, heart disease, cancer, rotten teeth, gout and dementia[3]. You may have also recently seen an explosive report published by Tearfund showing the monstrous environmental devastation this brand is responsible for. They produce a hell of a lot of plastic but have zero plans to change this. When asked directly, the question was brushed off by Coco-Cola’s Head of Sustainability earlier this year, who said that consumers prefer plastic. Hmm…

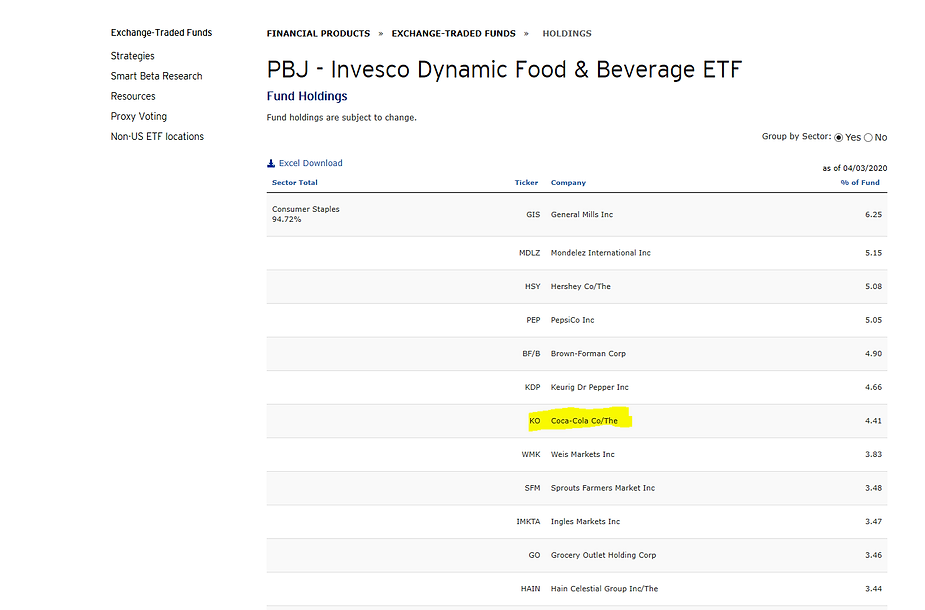

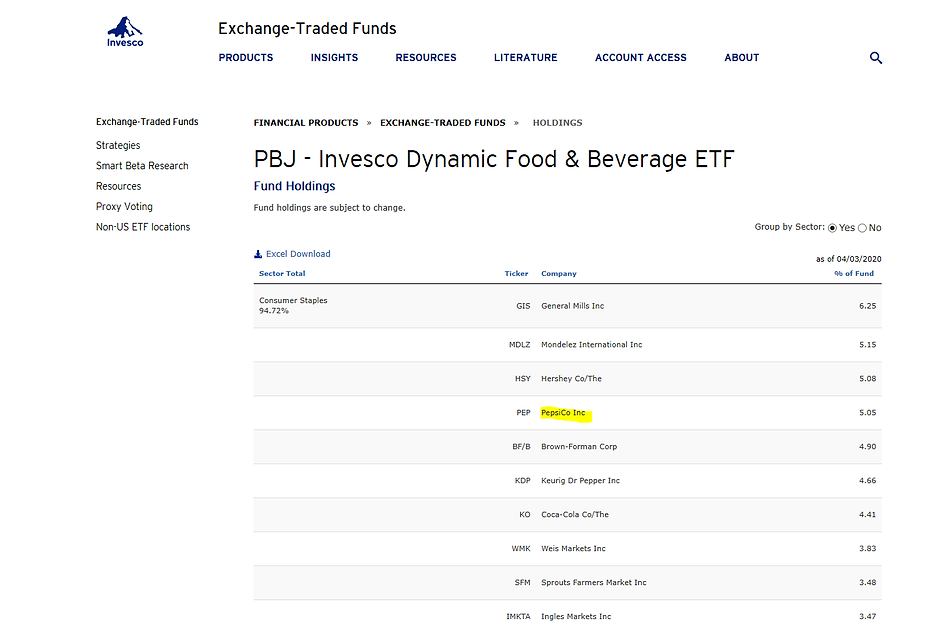

So, it’s probably no surprise to find out that this brand is a favourite among sin stocks. Coca-Cola features in one of the top five vice funds[4], Invesco’s Dynamic Food and Beverage ETF. This fund, which has been notoriously hailed as an “ETF worth sinning for” specialises in unhealthy, addictive and alcoholic beverages.

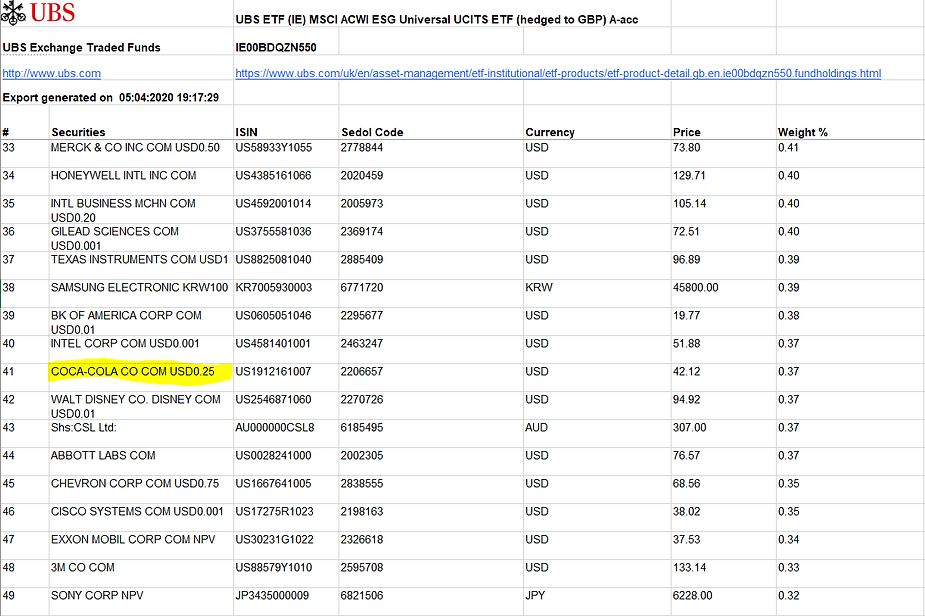

However, somewhat shockingly, this fizzy-drink powerhouse is a common feature in ethical funds too – usually landing itself in one of the top ten largest holdings. As we all know, they practically wrote the rules around marketing, and have managed to convince fund managers that they really are an ethical company. You can find them on ESG funds tracking the MSCI ESG ETFs or FTSE4Good indices.

3. British Petroleum (BP)

Are you a firm believer in ESG, as well as a lover of multi-national oil-producers? Probably not. But if you decided to get an ethical portfolio, there’s a good chance that your money is indeed funding BP. It almost feels unfair to pick on this massive oily enterprise because they have so many ESG scandals.

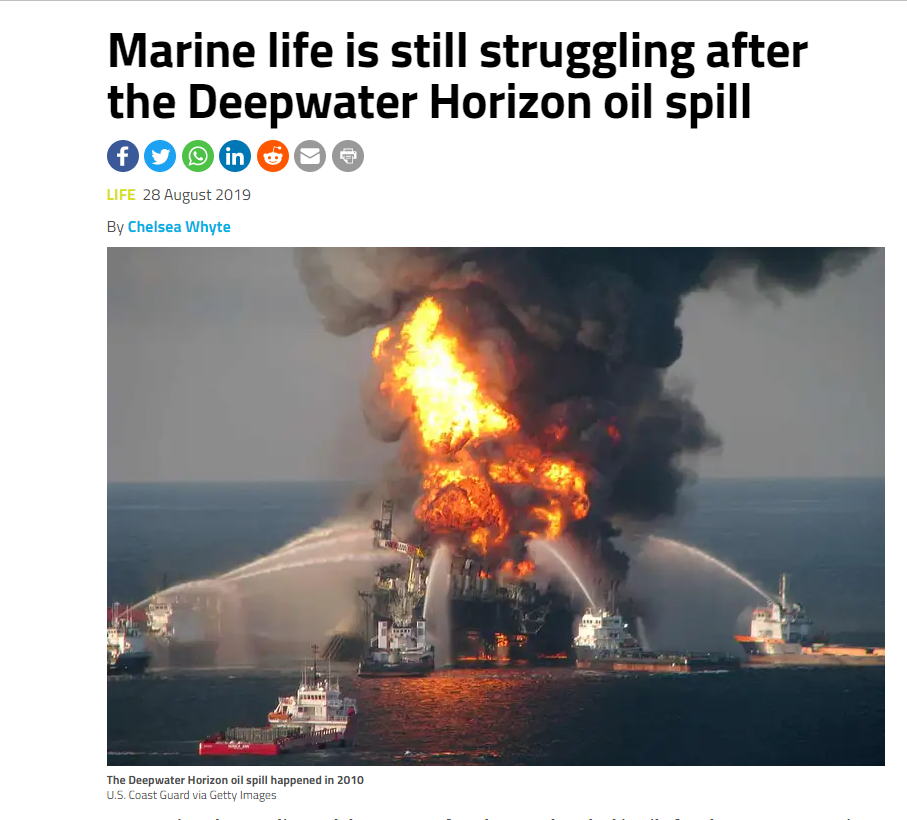

But the one we can’t ignore is the infamous 2010 oil spill. Slammed as the worst in the world, 205.8 million gallons of oil and 225,000 tons of methane were released into the Gulf of Mexico. It’s believed that 82,000 birds of 102 species, 6,165 sea turtles and 25,900 marine mammals and uncountable fish were harmed or killed as a direct result[5]. Along the beaches many dead infant dolphins were washed up covered in oil, not to mention thousands of other creatures too. The impact is still being felt today with “dead zones”, devoid of marine life in the worst hit areas.

So have they cleaned up their act? Not really – it’s been revealed that last year the oil company spent more than $53[6] million lobbying against the climate crisis.

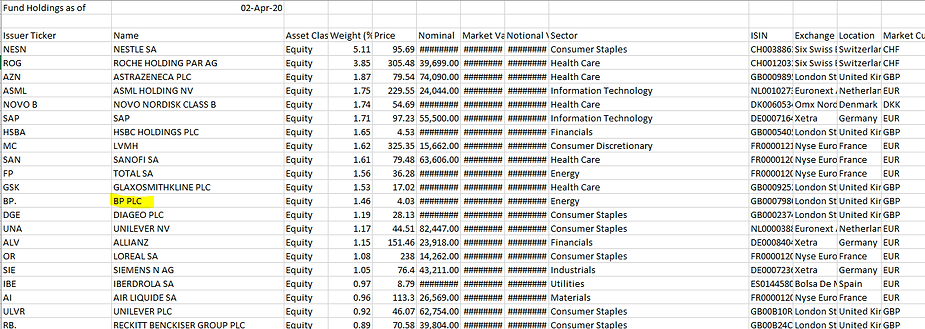

But why should that stop them featuring in our ethical funds and being classed as an exemplary ESG corporation? You can find BP among the MSCI index tracker funds, such as here in the iShares MSCI Europe ESG Screened UCITS ETF.

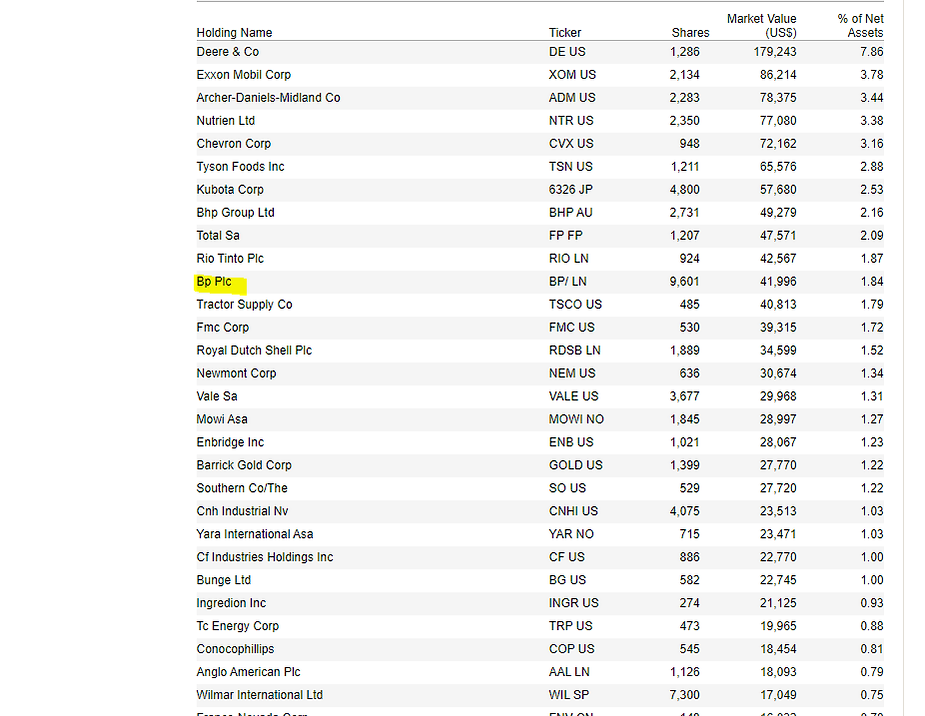

While not strictly listed as a vice fund, you can obviously find BP on ETFs which focus on fossil fuel energy. For example, you can see BP listed here on the VanEck Vectors Natural Resources UCITS ETF.

4. Royal Dutch Shell

If you had to pick your jaw up off the ground when you read that BP is considered an ethical company, you may as well leave it there as we move onto Shell. As an oil tycoon, it’s probably not the first company that springs to mind when you think of ESG. But according to CEO Ben van Beurden, we all need to look at the bigger picture. Apparantly “carbon bubble” critics “ignore reality” and what’s needed is a “sustained and substantial (oil) investment to increase growth”.

As well as oil, Shell is investing in more clean energy, but does this make them an ESG company?

In March, they reported a 41% rise in oil spills in Nigeria[7], albeit from theft or sabotage. They’re currently in the midst of a corruption scandal[8], which doesn’t look promising for their ESG credentials either.

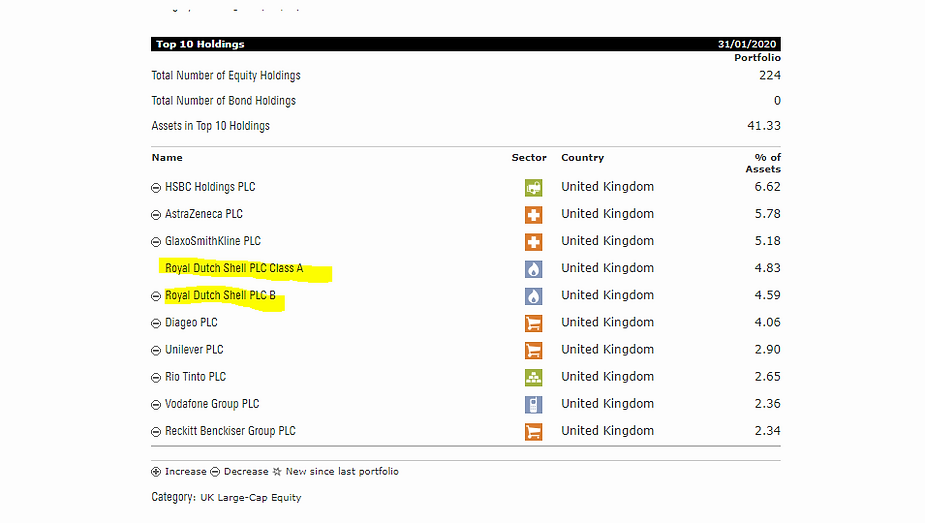

Yet astonishingly, several ethical funds have Shell in their holdings, as it is included in the FTSE4Good companies, for example Royal London UK FTSE4Good Tracker Trust.

Much like BP, Shell have re-branded themselves as a responsible, mother earth company by promising carbon reductions in the future[9]. It’s a dubious definition of “ethical”, but some investors would argue that it makes more of an impact to support change, rather than investing in companies who are truly sustainable from the start. The argument has a few holes in it but has certainly been the golden ticket for these oil tycoons.

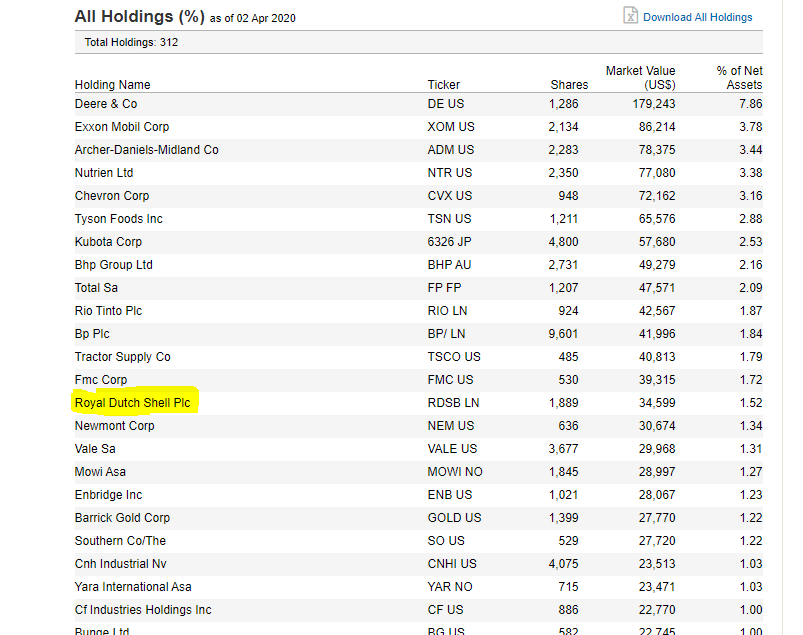

Unsurprisingly, you can find Shell on the ETFs with a penchant for fossil-fuel, carbon-emitting energy companies, such as VanEck Vectors Natural Resources UCITS ETF.

5. PepsiCo

Pepsi, the famous rival to Coco-Cola, the blue to their red, the Christina Aguilera to their Britney Spears. But on an ESG level, they have a lot more in common than they might like to admit. Recently an explosive report by Tearfund brought to light the damage caused by Coco-Cola, PespsiCo, Nestle and Unilever. Together they produce enough plastic to cover 83 football pitches every day, leading to 4.6 million tonnes of carbon dioxide – the equivalent of 2 million cars[10].

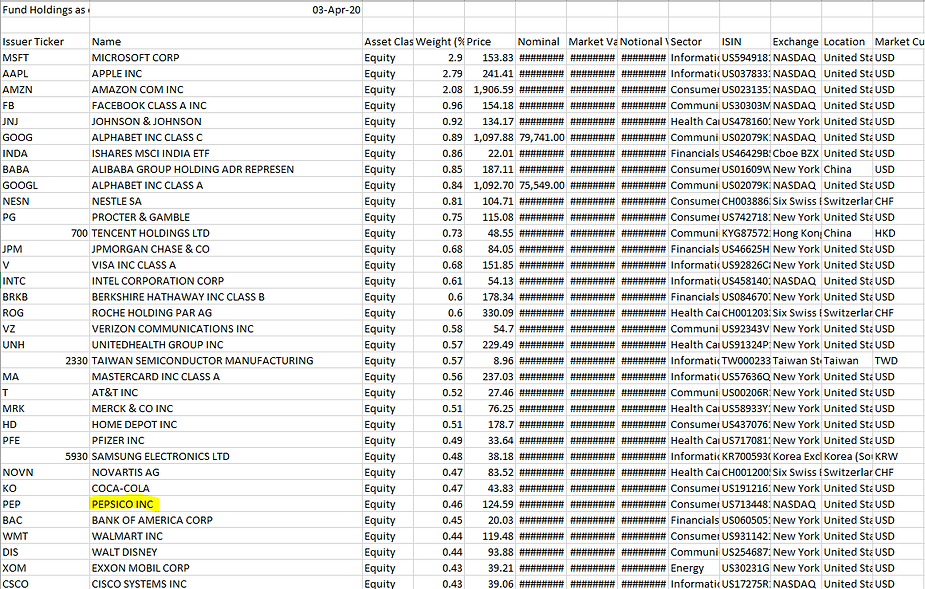

So, how are they sustainable? Well, they’re promising to use more recycled plastic in their packaging over the next five years. Would you say that classifies them as an ESG company worthy of investment? MSCI seem to, as you can find them in tracker funds such as in iShares MSCI ACWI ETF.

Unsurprisingly, of course you can also get exposure to this soft drink sovereign across Vice funds too. Like it’s badass buddy Coco-Cola, it’s fizzing and popping here in the Invesco’s Dynamic Food and Beverage ETF too.

The ESG investment space is incredibly broad and green washing – or to use a more accurate word, bullshitting, is rife. Before putting your money in an ethical portfolio, it’s worthwhile to check the holdings first.