Updated: Jun 10, 2021

This is the problem with publishing your opinions, isn’t it? Sometimes you find out that you got it wrong.

A few weeks ago, I wrote this blog to try and highlight that our current negative screening and ESG standards are not up to standard. To make that point, I used BrewDog as an example.

That’s how I unwittingly became part of the greenwash machine.

What we since found out is that BrewDog has a toxic corporate culture. Bullying is rife, starting from the top. So I want to say sorry to anyone working at BrewDog who read my blog. I didn’t realise. And I should have researched it better. That was my responsibility.

I’ve kept my original blog here, because I don’t want to erase my mistakes. But of course, I no longer think that BrewDog is the best company ever. Far from it.

What I’ve learned from this is that companies who plant trees are not necessarily good ones. They require the same level of scrutiny as the others.

Original blog:

BrewDog is a wakeup call for fusty old ESG investment standards 🍻 ⏰

(ESG = Environmental, Social, Governance … in theory!)

Is there a better company than BrewDog? Like, seriously?

- They are the world’s first ever carbon-negative brewery and bar chain 🌿

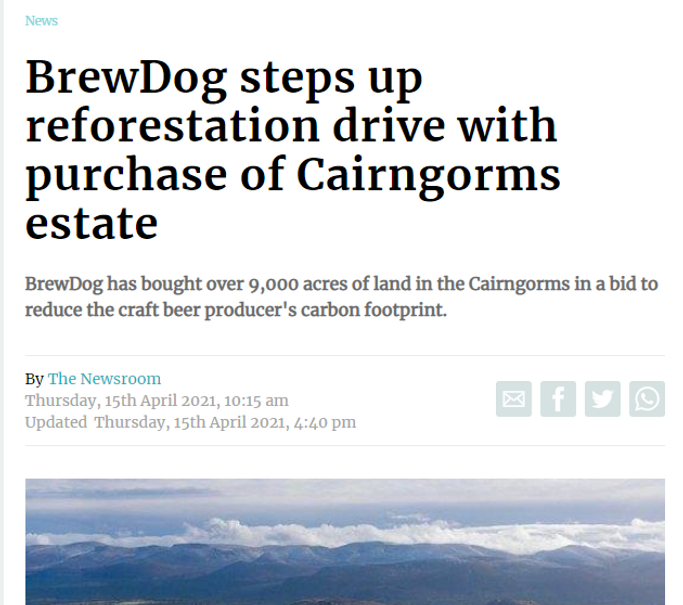

- They’ve purchased a 2050-acre Scottish forest to protect it and plant trees🌳

- … 1 million trees to be precise! Plus restore 650 acres of peatland 🌳🌳🌳

- BrewDog then purchased ANOTHER 9,000 acres of woodland to protect 👇

- They’ve created a sustainable campsite to educate people 🎓

- They work with off-setting partners all over the world 🌏

- This list isn’t everything … it’s just the highlights. 🤩

BrewDog are so good for the planet I felt morally obliged to change my beverage of choice 🍻

I should start by saying that BrewDog isn’t paying me. 😒 I can assure you I’m not chugging away free beer or living some kind of Scottish high life at their expense. (Nobody pays for any of the content on this blog by the way).

Nope. I am on the Newport to London train, broke as hell until someone pays an invoice 😅. Freelance life. This is a post from the heart.

Truth be told, BrewDog wouldn’t have been my first choice a few months back. (Sorry BrewDog). I’m more of a fruity, honey IPA drinker. It’s nice to drink and fun to say. 😋

But the thing is, how could you NOT support a company who’s on a mission to stop the world becoming a heaving ball of molten lava!?

How can you be fussy about your hops and pops when they’re literally planting trees every day to save us all from natural damnation?

This is a company that is doing so much good for the world, they’ve made me change my drinking preferences. Which, as we all know, is a big ask for a Brit. 😅

BrewDog is SUPER SERIOUS about ESG 🌿

BrewDog is trailblazing a genuine path towards serious sustainability. None of the “Ohhh but we have a woman manager so we’re sustainable” bollocks. (Thanks for that, you patronising arse). Or the “Did you see our new recycling bin? Now we waste 30% less bottle tops” crap 🤥. No.

This is hardcore, genuine, serious stuff. ESG done properly.

If BrewDog’s approach to sustainability was a drink, it would not be a beer. It would be the kind of absinthe that leaves you blinded for several days, and hallucinating for life thereafter. (Or a Tuesday night, as we prefer to call it in the Valleys).

When it comes to sustainability, BrewDog means BUSINESS.

When BrewDog go public, they SHOULD be on every ESG fund list

So, you’d think that the moment BrewDog arrive on the stock market (anticipated to be some time in 2021, but no exact date as yet … James Watt you tease!), ESG managers would be falling over themselves to get shares.

FALLING. OVER. THEMSELVES.

Clamouring all over each other, like hundreds of tiny lemurs with little slicked-back ducktails .

But no! No, the majority probably won’t. Because of a random outdated rule that says alcohol must be excluded from ESG funds.

Oh. And we’re not talking religious funds here, we’re talking plain old ESG. The sort of ethical investing that atheists like me want to put our money towards.

Alcohol is blacklisted from most ESG investment portfolios

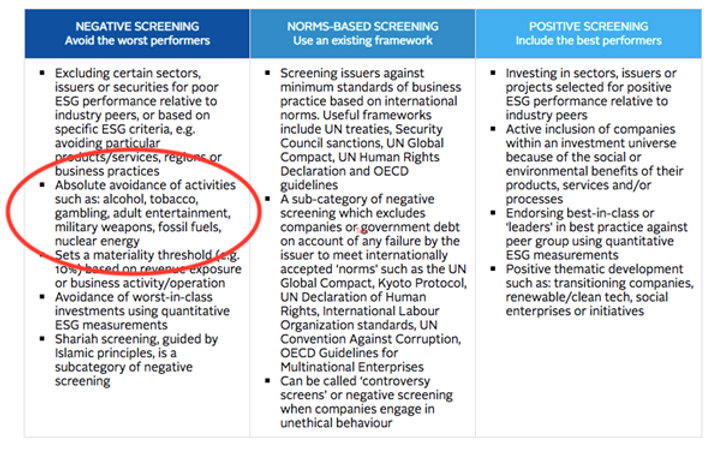

For some reason, shares and bonds in alcohol get vetoed at the start of the ESG investment journey.

Known as ‘negative screening’, it’s kind of like Level 1 of building an ESG portfolio. It’s the most basic form of ESG.

Take a look at the PRI table below, it explicitly lists alcohol as a ‘worst performer’. Alcohol apparently cannot be ESG.

Why is this? Well, to be honest, there’s not that much on the subject out there. I googled around, expecting to find some material justifications for excluding alcohol from ESG funds. But no, nothing much.

So I guess the debate will have to start here! 🎉🍻

I’m not sure why alcohol is blacklisted, but I think it must be health-related 🤮

I suppose the main reason for excluding alcohol would have to be because people get drunk, addicted and even die from drinking too much, right? Chronic heavy drinking can cause:

- Liver disease,

- Pancreatitis,

- Cancer,

- Gastrointestinal problems,

- Immune system dysfunction,

- Brain damage,

- Osteoporosis,

- Heart disease,

- Weight gain,

- Lewd behaviour … I’ve spent enough time in Cardiff’s Chippy Lane to have no problem believing that!

I get it, alcohol causes damage. Even lightweight beers. So, I suppose that’s the rationale for why most (all?) ESG funds have zero alcohol exposure. And even less investment platforms include it on their ready-made portfolios.

So, I’m a bit sad to say that I think BrewDog possibly won’t appear on our sustainable funds and portfolios. Which sucks.

Because BrewDog would be the most perfect ESG investment ever. A lot better than the companies already on the list.

Companies that SHOULDN’T BE in the ESG fund holdings, but somehow gate-crashed 🤦♀️

So BrewDog may not make it onto our ESG fund holdings. Because it’s alcohol. But I think this is madness. Because many of the companies classified as ESG are terrible. The planet would have been better if they’d never existed.

To show you what I mean, I’ve picked a common ESG fund, the MSCI World ESG Screened UCITS ETF. And I’ve listed some of the fund holdings that I found the most offensive. 👇👇👇

You can read the full list here.

My most offensive companies on the ESG fund list include:

- British American Tobacco 🚬 Smoking accounts for 10% of all deaths each year, while alcohol accounts for 3.8%.

- Exxon Mobil 🏭 No words.

- Coco-Cola 🥤 … Hello? Plastic pollution? Obesity epidemic? Diabetes?

- PepsiCo🥤 Same as above.

- McDonalds 🍟🍔 What pumps out more hot air and bulls*** than McDonald’s amazon-destroying cattle farming? Their CSR department.

- Starbucks ☕ Easy to remember the logo, because their single-use packaging is so often littered across every road in the world, and crammed into bins.

- Total 🏭 Total BS more like.

- John Deere 🚜 John Deer, could you stop selling machines designed to cut down trees and other plants please?

- Target 🛒🏪 No words.

- Rio Tinto 🧨 You know those really sacred aboriginal caves … oh wait. Never mind.

- British Petroleum 🏭 Ffs. Honestly, you couldn’t make this stuff up. BP is listed on ESG funds at the height of a climate crisis. Oh. By the way … Here is a great story about how BP sued the charity Greenpeace last year as they protested their new fleet of oil drilling. Some of our ESG money went into that legal case. My money. Your money. This is what it did.

As you can see, some of these companies fall into the category of fossil fuel extraction or tobacco. But somehow they dodged the negative screening filter. They did this by saying that they are developing “alternatives” to things like dirty energy and smoking. The general rule is that no more than 10% of ESG money can go towards these activities. But 10% of billions can still do a lot of damage.

Five companies that appear on both vice funds and ESG funds.

There is a lot of bulls*** mixed into our ESG funds, 💩 because the rules are outdated, and manipulated by corporate psychopaths. 👿

It’s time for ESG screening criteria to be re-written ☝

If you take nothing else away from this blog, I hope you’ll take this: Our ESG rules are a mess. 💩💩

They barely work in theory and they don’t work in practice. I believe that they should be re-written, in-line with our times and most pressing issues. Dirty companies need to be kicked out. Good companies must be put in – even if they are alcohol brands. 🍻🍾

The focus has been on ‘Sustainable’ and not ‘ESG’ investments

Regulators have already been working hard to put some substance into what legally qualifies as a ‘sustainable’ investment. Most obviously, we now have the EU Taxonomy.

Oh. And by the way, some of the companies I’ve listed above, including BP, actually spent tens of millions trying to block the taxonomy regulation, which speaks volumes about their true motivations. They’re still at it. 👇

But the sustainable taxonomy is winning (sort of). And bit by bit, we’re seeing progress which can help to stamp out corporate greenwashing (a nice word for ‘bulls***ing’).

Many nations, including the UK and US are now looking into creating their own taxonomies too. “Sustainable” investments are finally, slowly beginning to mean something.

Where is the progress for ESG? 🤷♀️

But the same cannot be said for ESG.

Why do we have rules that exclude good companies? And how is it that SO MANY evil companies are in the ESG fund holdings? I could understand if it was one or two sneaky little guys that nobody really knows. But these are BIG MOTHERF***ERS. McDonalds can’t “sneak” in. BP can’t quietly gate-crash.

There is something systemically wrong. Maybe it’s corruption. Maybe it’s yet another ratings scandal like 2008. Maybe it’s something different. But whatever it is, it is DESTROYING our planet. 🏭🔥🌏

ESG investments surpassed $2 trillion in 2021. But how much of that went straight into the wallets of oil tycoons and fast food brands? How much of that was fake? 😣

We’ve GOT to do better. We MUST double check our fund holdings and make a massive fuss.

And while we’re at it, let’s also do something that will actually help save the planet… BrewDog anyone? 🤷♀️ 🍻

These views are my own! They are my opinions based on research and experience. While this content is intended to be helpful, it is not advice.