Updated: Jun 14, 2022

The UK is just three degrees away from being underwater. Three.

But the very thing that caused the crisis – money – can also become the solution.

Here’s a run-down of why sustainable investment is critical. And how greenwashing is stealing our last chance of survival.

The only way to fix the climate crisis is with investment

The OECD have calculated that to survive the climate crisis, we MUST invest $6.3 trillion into the planet each year from now until 2030[1].

Remember that figure. $6.3 trillion. It’s a CRAAAAAZYYYYY load of money. Crazy. For context, the entire annual GDP of the UK is $6.9 trillion (2020). 🤑

$6.3 trillion must be invested in sustainable infrastructure each year

What’s more, this investment needs to be highly targeted. It can’t just be spread anywhere like spritzing perfume at an airport shop. Green finance has a place to go. 🎯

- Around $4 trillion[2] urgently needs to be invested in Asian and African infrastructure. Because that’s where the most carbon inefficiencies are occurring. The sooner we can plug carbon gaps there, the more impact we’ll achieve.

- In terms of sectors, renewable energy plants take priority. This means a lot less oil, and a lot more wind, solar and hydro plants. Renewable energy plants need to grow by 500% each year. 500% per YEAR. COMPOUNDED.

This is an incredibly ambitious target, but ESSENTIAL for our survival.

If you’re interested in discovering more, there are detailed roadmaps about WHERE the money needs to go and WHY.

👉 I recommend Race to Zero as a good resource. 👌

The money needs to come from us, ordinary people

$6.3 trillion a year is a LOT of money – WAY too much for governments to handle on their own. And so, 70% of the money needs to come from us. The people around the world. Our savings, our investments, our pensions.

70% of the money needs to come from the people

This was a key topic in COP26. Mark Carney famously said, “Achieving the climate goals will require all forms of finance”. And he was talking about us. Our investments can save the planet.

But wait… before any readers spiral into a dark place … there is really good news!!

We HAVE the money 🎉🤩

If you’re looking to restore your faith in humanity, just take a look at the floods of people investing in sustainability and ESG. Over 2021 alone, more than $2.3 trillion of ADDITIONAL investment poured into the space.

That’s basically 70% of the target. Which is UNBELIEAVE RIGHT?! We’re on our way!

🤔🤔🤔🤔

Suspiciously good progress… Something isn’t right

The amount of money flooding in is breath-taking. Staggering. You need to sit down and flap a big fan in your face to process it. Investors clearly want to be sustainable. They’re putting their money where their future is.

Bloomberg predicts that ESG (Environmental, Social, Governance) assets are projected to hit a staggering $41 trillion this year. Rising to $53 billion by 2025.

But … Something isn’t right.

We need to hit $6.3 trillion a year to hit our climate goals. That’s the figure. But we have over SIX times that amount. If we already have $41 trillion, the problem should be already solved. Right?

I’m no math expert but something isn’t adding up.

The climate problem is not solved. You only need to turn on the news to see how worried scientists are. Or take to the streets to see the plastic and carbon pollution. Even the weather is chaotic with floods and droughts hitting us harder than ever before.

Somewhere between the $6.3 trillion target, and the $41 trillion reality… there’s a flaw. A glitch… A lie? A lot of lies. Greenwashing. 😡

ESG funds are filled with non-ESG companies. 💩REALLY non-ESG. 💩💩💩💩

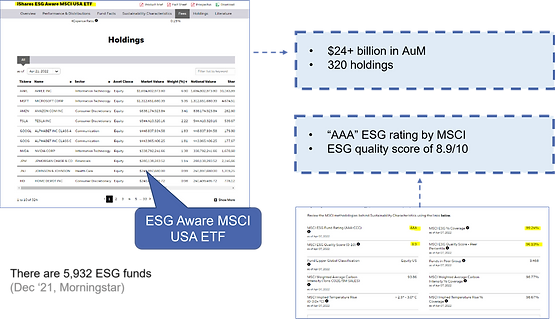

To find out what’s going wrong, you only need to follow the money. There are 5,932[3] “sustainable” funds in the world. And this is where the bulk of the money goes. Some of these are HUGE. Like the iShares ESG Aware USA ETF.

This mega-fund has a staggering $24 million in assets. This money is split between 320 holdings, which should all be ESG. This fund has an ESG rating of AAA. This fund SHOULD be the BEST of the BEST.

This fund SHOULD be investing in true sustainability and ESG. At a minimum, you’d expect it to be filled with companies with a sustainable business model. You know the kind of thing… plastic alternatives, sustainable waste management or meat alternatives, for example.

So… What is this “ESG” fund filled with?

Scanning through the fund’s holdings makes for shocking reading.

Here are some of the main holdings:

- McDonald’s – Yep. The Junk food company responsible for creating two million tonnes of waste[4] each year(!!), while contributing significantly to the obesity epidemic. 💩

- Coca-Cola & PepsiCo – Two of the world’s WORST plastic polluters!!! Check out more details here. 💩💩

- Chevron – The very same Chevron who’s currently in a lawsuit for greenwashing[5]. Between them, Chevron, BP, Shell and Exxon Mobil (also in this fund) account for more than 10% of all global carbon emissions since 1965[6]. 💩

- Starbucks – Hard know where to begin! Maybe the 6.2 million gallons of water wasted EVERY DAY[7]. Or the billions of disposable coffee cups thrown into landfill. Perhaps Starbuck’s heavy contribution to soil erosion and unsustainable coffee bean farming… Plenty of choice. 💩

- Target – Because the world needs more cheap and disposable plastic goods, right?💩

- Microsoft (Such a prolific green-washer, this tech conglomerate deserves a blog of its own… watch this space 🔥)💩

- Exxon Mobil – Sure, why not throw in a company that spends $20 billion a year digging up fossil fuels? Just 0.2% of it’s capital goes towards low-carbon energies[8]. 💩

… AND MANY MORE!!!💩💩💩💩💩

I can’t go through each of the 320 companies now or this blog would spiral into the listicle from hell.

But I implore you to take a look!

👉👉👉👉👉 Here are the fund holdings. 👈👈👈👈👈👈

Please research and come to your own conclusions about whether or not this is greenwashing. And if giving $40 trillion to these kinds of brands is going to save the planet.

Greenwashing SUCKS 😖😖😖😖

Sometimes when I write these blogs, I feel like I’m sounding a bit dramatic. Like I need to chill out and be more professional (6 years in investment management, a catholic upbringing and an all-girls school will do that to you).

But I’m not being dramatic. I’m telling the truth. Repeating the facts. With zero agenda. Zero payments. Zero incentives.

Here are the facts:

- We are three degrees away from being under water

- Money can fix it

- The money is going to the companies that caused the problem

It’s a vicious cycle. Somehow, we have to break it.

[1] Source: OECD [2] Source: OECD [3] Source: Clean Energy News [4] Source : The Takeaway [5] Source: World Oil [6] Source: NPR [7] Source: GreenBiz [8] Source: ClientEarth