WHAT IS LIFE REALLLLLLYYYYY LIKE FOR FINTECH FOUNDERS? Is it stressful? Is it instagrammy? Do they have groupies? What’s the status on being a billionaire?

To help me find out, I asked 32 real-life fintech founders over November 2021 – February 2022. Why 32? Because that’s how many I know. I was aiming for 50. … Didn’t get there. What can you do? We all have limitations. Mine is friends. 😅😂

These are REAL founders. Not pretend ones. Not ones who call themselves founders for any old slapdash reason.

These are people who had an idea, quit their job, built a concept from the ground up, got funding, employed others and have a legit financial technology company. Every time you talk to them they will CHEW YOUR EAR OFF about pension apps, investment things or something blockchain. And when they have eaten both your ears, my god, they’ll go for the brain. You will come out of there a brainless fintech zombie with no reason left for living. (Also thanks for doing my survey guys).

Here’s some more information about who DID take part in my big (well, for me!) fintech founder survey:

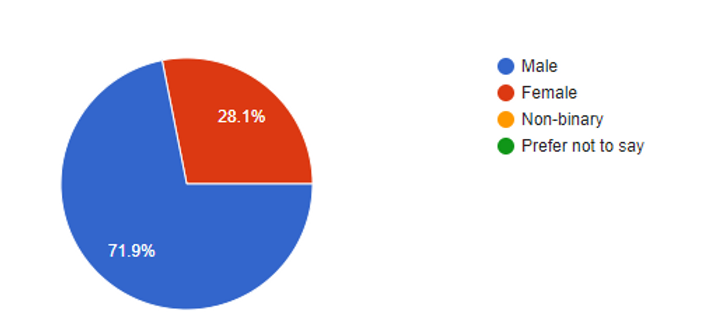

72% men and 28% women

Ok so, while men do make up the majority of fintech founders in my study, 28% were women (yayy!). This is quite a lot higher than the official 13%[1] of female fintech founders in Europe.

It may be because my personal work friendship group has more women in it. Because us women in finance sort of seek each other out. Like a little sanctuary among the receding hairlines and uncalled-for grunting. And also because I did a lot of interviewing for Swashbucklers and Buckaroos.

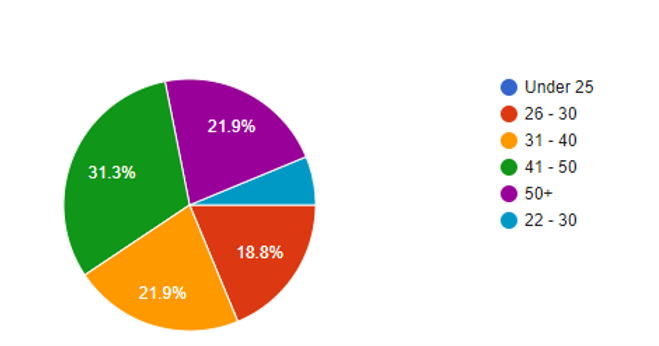

Ages ranged between 26 and 50+

The ages were well spread and diverse, which I’m happy about.

There were slightly more 41-50 year olds than any other group, but not enough to skew the results. Yay.

You guys I screwed up this part of the survey a bit. Forgive me. On a whim, I decided half-way through that I’d like to see if there were any under-25s. I don’t think there were. But it messed up the chart. Slow clap for me.

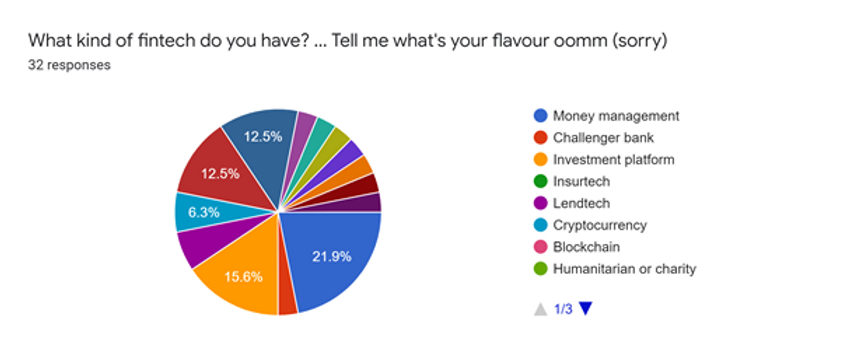

What kind of fintech did the founders create?

Every kind! Honestly, every kind in the world. (Participants could decide their own category if the ones I created didn’t fit… and oh my days they went for it! My little multiple-choice became a pitch! I felt like I needed to get my empty wallet out and take notes)

In the ends, there were 17 categories.

Here is the full list:

(Pre-determined categories)

- Money management

- Challenger bank

- Investment platform

- Insurtech

- Lendtech

- Cryptocurrency

- Blockchain

(Created their own category)

- Humanitarian or charity

- Payments

- SaaS or white label

- Search engine

- Mortgage overpayments app

- Community banking/DeFi

- Gen Z solution

- Mobility Tech

- SaaS, White Label, Insurtech, Market…

- Embedded Finance platform (next generation Banking-as-a-Service)

22% of participants had founded a money management platform.

The second most popular category was investment platform, with five participants.

This could be because I am an investment writer and so my connections are linked to that world. Literally, my business name is Hannah Duncan Investment Content Ltd. I’m crazy into investments. And content.

How big are the fintechs?

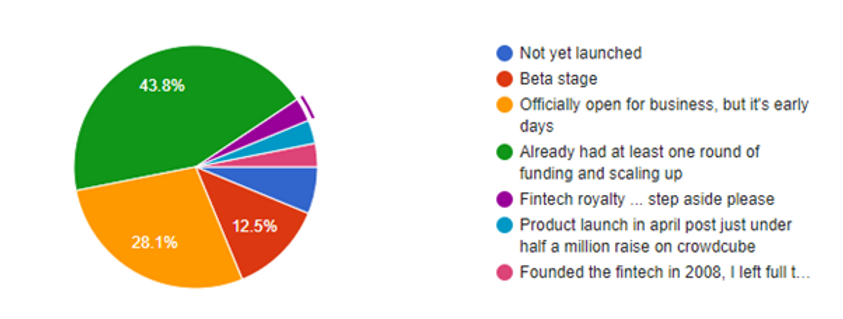

What stage is everyone at?

So, all my fintech founders are genuine. I know this because I’ve researched them all and even written articles about them in magazines and newspapers. Many have won awards. Fintech awards. So, I know they’re legit. But HOW serious are they?

Well, 43% of participants already had at least one round of funding and were scaling-up at the time they took the survey. And 28% were well past that stage and properly open for business.

3% classed themselves as Fintech Royalty. And I know that’s true because I see this one’s adverts on the London Underground all the time. Can’t escape.

The rest were in various beta stages and in the process of launching or securing funding.

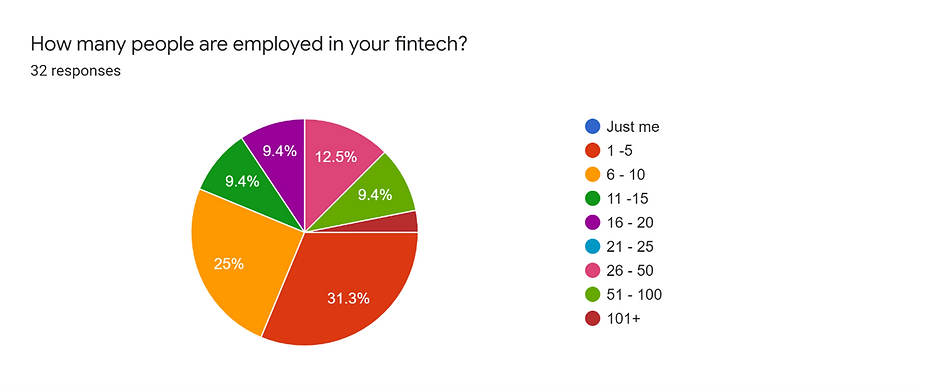

How many employees?

Most of the fintechs (31%, ten participants) had between one and five employees working at their firm.

In second place, a quarter of the participants (eight fintechs) had more than six employees and less than ten.

Then in third position, 12.5% had between 26 and 50 people working for them.

One fintech even had more than 100 employees! You jammy thing. Next time I’m upping my fees.

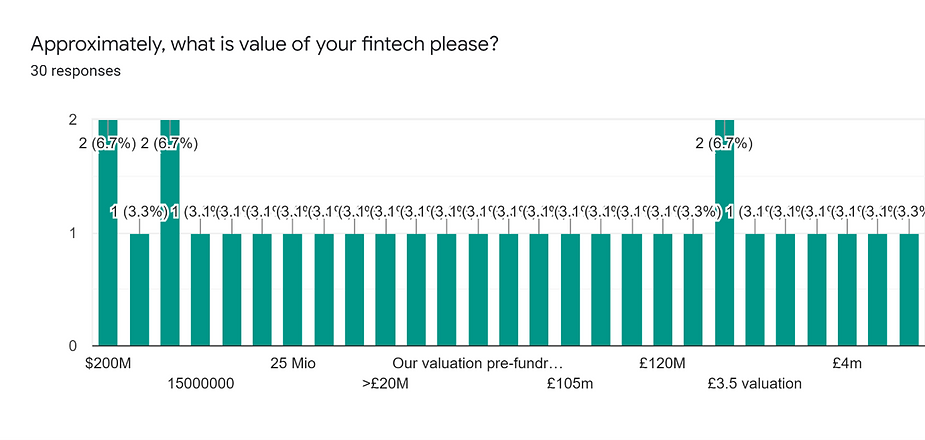

Valuation

Asking this was a mistake. Just look at the state of my chart!

Honestly, I don’t know what to make of this at all. From what I can tell, the valuations range from £3.5 million all the way up to £200 million. I’ll leave you to puzzle that out.

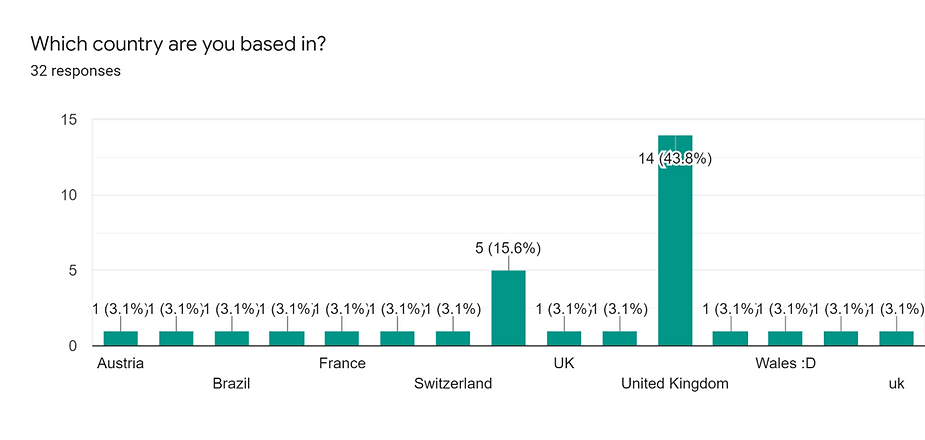

Location

Another one I didn’t think through properly. Well, from what I can tell, the overwhelming majority of the fintechs are based in the UK. (Shout out to Wales, land of the free spirited and home of Chippy Lane!)

With a couple based in Europe – France, Switzerland (both countries I’ve lived in, so no surprise there) and Austria. And then a cheeky one from Brazil yay!

So, there you have it! Here are the people who took part in my survey

YEEEEEEEES the average fintech founder was a UK man aged between 41 and 50 (I know, I know).

The average fintech was already up-and-running with between 1 – 5 employees, and it was most likely to be a money management or investment platform.

Most fintechs were based in the UK and they were worth god knows how much because I screwed up the chart.

Next I’m going to analyse the juicy bits!! It’s going to be all about money, funding, salaries, employees, lost weekends and missing paycheques. All the stuff you really want to read!

Stay with me… This will take weeks…

Thank you again to all my wonderful participants!!!

🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏🙏