Updated: Mar 7, 2022

Think of your investment pot like a recipe, you need to add the right blend of this and that to get the result you’re after. Like cooking, everyone has different tastes. You might go for a super risky spicy chilli mix, or you might prefer an easy and gentle pumpkin soup. In the same way that there are different families of ingredients (my favourite is the onion family), investments are also grouped into four main types. You can mix and match them to find a blend which works for you. With the right balance, you can start benefiting from your pot and growing your wealth. Here’s a quick and simple overview of the four of the main types of investment out there to get you started.

How do people buy and sell shares?

The first step to understanding shares is to get an overview of how the stock markets work. A stock market is essentially place where you can buy and sell stocks and shares in companies which have been listed on that market. For example, here in the UK, we have the London Stock Exchange (LSE) which (as of December 2019) has 2,055 companies listed on it[1]. On an average day, the LSE will see 818,000 trades[2]. As you can imagine, it’s pretty busy over there! Worldwide, there are 60 major stock markets[3], with around 630,000[4] companies available for buying and selling. When you buy shares in a company, you’re buying a slice of the ownership. You become an owner! Or for maximum bragging, the official word is “shareholder”.

Often one share is really small amount of ownership. So, as an example, the well-known supermarket brand Tesco Plc has issued 9,793.50 million[5] shares. Therefore, if you buy one of their shares, you’ll own around one ten millionth of Tesco Plc, and that’s how much of the profit you’ll be entitled to. It doesn’t sound like a lot but owning several shares can be very significant. Owning a ten millionth of an up-and-coming company is serious business!

People buy shares that they think will make a profit in years to come. While they’re holding the shares, they’ll get their split of the profit, which is called a “dividend”. Dividends are normally paid to shareholders three or four times a year. Sometimes the profits can get reinvested into the company and this can get the shareholders a bit jumpy or excited depending on the circumstances. After some time has passed, shareholders sell their shares to a buyer, ideally for a profit. This is the basic premise of how investors use the stock market.

What are bonds?

Of course, there are other types of investment which are also available. Some people find that buying stocks and shares is a bit risky in case the company doesn’t do well. After all, far more companies don’t make the distance, and it’s a risk when you put your money into a company. For some investors, the thought of this makes them feel a bit sick and queasy. Like the kind of unshakeable hangover my friends and I now experience when we go out drinking during the week. It’s not a nice feeling, and for some investors the potential return is not worth the nervousness they feel. These people are better suited to less risky investments, for example which do not involve share ownership.

If you feel nervous about investing, you can find some helpful tips here

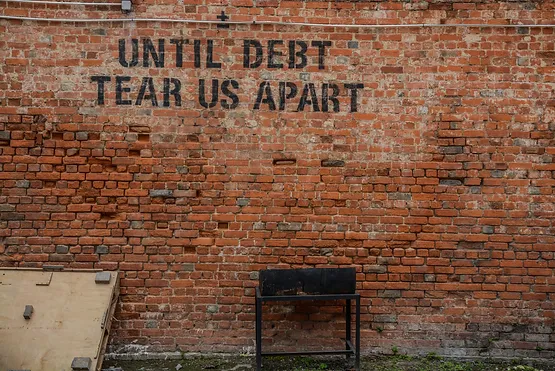

Fortunately, many companies, governments or organisations want to raise money, but don’t want to sell shares. They’d prefer to borrow money and pay it back over time with interest. It’s very similar to taking out a mortgage. The most common way of doing this is with an investment opportunity called a “bond”. Investors will buy bonds from a broker (not on the stock market) or in some rare cases directly from the government. They’ll lend money, which is repaid over time and pick up interest along the way, known as “coupons”. Bonds are unlikely to make as much money as stocks and shares, but they are also less likely to lose money, so it’s pretty balanced. But be aware! In some cases, bonds can be even riskier than shares! There are elaborate credit rating systems to help you sort the bad payers from the good ones. Make sure that you are clued up on all these details before you take the plunge.

Keeping spare cash (or cash equivalents) in your investment pot

It’s especially important to have some spare cash in your investment pot so that you have breathing room. This will mean that you can snap up some bargains if you want to or even withdraw money if you really need to. Now I’m going to explain something a bit abstract, but I’m sure you’ll get it. When investors are talking about “cash”, they use the word “liquidity”. But when they’re talking about liquidity, they’re really talking about things which are not cash, but could easily become cash. Did that make sense? They don’t like the idea of cash just sitting in an investment pot, doing nothing and getting eaten away by inflation over time. They invest the cash, but in things which they can sell in a heartbeat and get the money. Cash equivalents are meant for short-term investing and their defining feature is that they are highly liquid (or super quick and easy to sell). If cash equivalents are Freddie Mercury, liquidity is the moustache. You’d spot it a mile off. Some examples of this are US government treasury bills, bank certificates of deposit, bankers’ acceptances or corporate commercial papers[8].

Going alternative

This is the part of investing, for me, where things can start to get a little unconventional and psychedelic. I really like it, but the rules definitely feel a little different out here. The simple answer is that alternative investments are anything which falls outside of stocks (or “equity“) , bonds (or “fixed income“) and cash.

Alternative investments could mean things which you can pick up and touch (if you’re lucky to get close enough!) such as fabulous art, collectables or valuable wine. This could also mean things that you can’t touch such as valuable financial agreements (including bets), crypto currency like Bitcoin or shares in companies which are not listed on the stock market. Something that they all have in common is that their value is not strongly linked to what’s going on in the stock market[9].

As an individual, it can be tougher to get your hands on an alternative investment. You kind of have to be in the know. This is one of the areas where the experts have a real edge. Alternative investments can get complicated quickly. It’s hard to gauge how much things are actually worth at different moments in time. The stock market is quite efficient because so many people are looking to make a profit. Buyers and sellers don’t want to give an inch! This can make the prices pretty accurate (although some economists disagree). Away from the market on the other hand – how can you know the true value of a bottle of wine or a company which hasn’t been listed? Because the prices are not that transparent, they are normally not very liquid.

Despite, or maybe because of their complexity, alternative investments have a bunch of advantages. They can help to mix up your investment pot so that everything isn’t hanging onto the stock market, which can be great during recessions or market downturns. They also have more chance of being undervalued, so you could have a decent chance of making more profit[10]. Just two years ago a 73-year old bottle of Burgundy sold at auction for $558,000, more than 17 times its original estimate. That’s the magic of alternatives … you just never know for sure!

…. What are investment funds?

This isn’t strictly one of the four main investment types, it’s a sort of sub-type. But they’re so useful for new investors that I couldn’t resist sneaking in an extra section.

One way to think of funds is to imagine a cake mix with many ingredients. Each of the ingredients represents several investments in a company or organisation, it could be stocks and shares, bonds or something else. You may not be able to afford to buy each of these investment ingredients individually, but if someone else mixes them into a really massive cake, you can afford to buy a very small slice. Buying into a fund is a good way for investors to get a good spread of investments, with less money. For example, looking at the fund prices this morning (22.01.2020), if you wanted to buy one share of the S&P 500 fund with Vanguard (Standard & Poor 500 Index is the 500 largest US companies listed on the stock market), it would set you back £48.53[6]. For this money, you’d benefit from being invested in 500 companies.

There are lots of different kinds of investment fund[7], the thing that they all have in common is that they are a group of investments which have been pooled together then divided. Most investors will have included several funds in their pot. It can often be a sensible idea to get a good mix. Not putting all your eggs in one basket (or not putting all your money in one investment) can help to avoid some sleepless nights!

… Feeling on the money?

So there you have it! The four main components of an investment pot – shares, bonds, cash and alternatives. If you want to start investing, you could either do it yourself (and I massively applaud you for that!) or you can get a team of experts to do it for you. I’ve explained more about how to start this process here. Whatever you decide to do, it’s almost definitely better than doing nothing. Keep researching and well done!

Nobody is paying me to write this. This article is intended to be useful, but it isn’t advice.

References:

[1] https://www.statista.com/statistics/324547/uk-number-of-companies-lse/

[2] https://www.statista.com/statistics/324547/uk-number-of-companies-lse/

[3] http://money.visualcapitalist.com/all-of-the-worlds-stock-exchanges-by-size/

[4] https://www.investopedia.com/financial-edge/1212/stock-exchanges-around-the-world.aspx

[5] https://citywire.co.uk/funds_insider/share-prices-and-performance/share-factsheet.aspx?InstrumentID=3069

[6] https://www.hl.co.uk/shares/shares-search-results/v/vanguard-funds-plc-s-and-p-500-etf-usdgbp

[7] https://www.investopedia.com/terms/f/fund.asp

[8] https://www.investopedia.com/terms/c/cashequivalents.asp

[9] https://www.syndicateroom.com/alternative-investments

[10] https://www.investopedia.com/articles/financial-advisors/092515/alternative-investments-look-pros-cons.asp