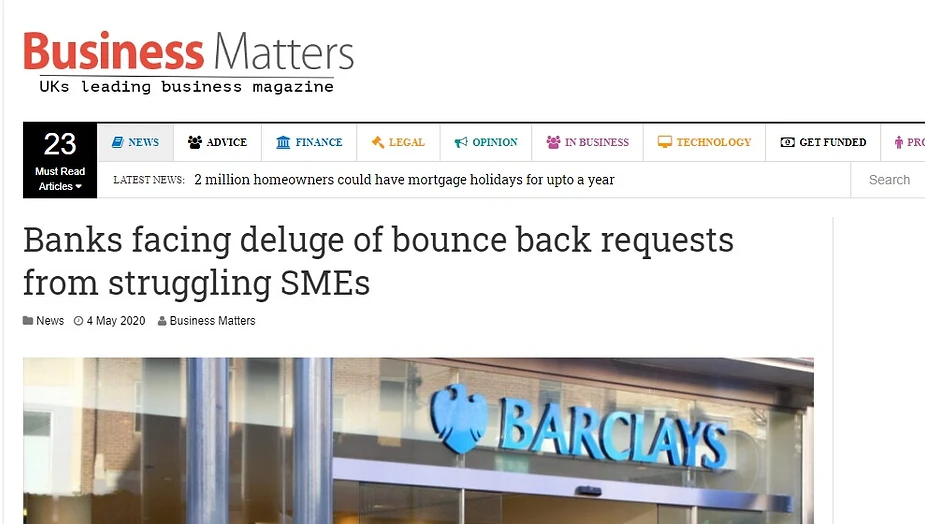

The 4th of May, normally known for its Star Wars fanatics, had a grim new record this year. That day, every two seconds, a small business applied for a bounce back loan[1]. More than 110,000 flooded the system, desperate for cash to pay debts and staff. That’s in the space of just one day. It’s not including the thousands of businesses who’ve applied for other government support schemes. It’s also not accounting for the 88%[2] of small businesses who will not be eligible or want to take on loans. There’s no sugar-coating it, small businesses are falling hard and fast.

Behind every single loan application is a business on the brink. At the heart of every struggling SME is a person seeing their life’s work and savings burn before their eyes. It’s a devastating time for Britain’s entrepreneurs. One survey taken at the end of April found that more than 55% of small businesses have “little or no” revenue due to COVID-19 measures[3]. Shockingly, a quarter[4] of Britain’s 5.9 million small and medium businesses believe they’ll now need to close. It’s traumatic, terrifying and truly disastrous for our whole nation.

If a small business can be saved, it must be. There are too many going down not to throw out as many lifelines as possible.

One person who’s seen the harrowing impact on business owners is Countingup’s CEO and founder Tim Fouracre.

Fouracre has made the suffering of small business his priority. Backed by over 450 accounting firms, he’s taken a leading role in lobbying government. In a public letter to Chancellor of the Exchequer, Rishi Sunak, he’s clearly identified the problems which need to be urgently addressed.

On Friday 9th May, I had the opportunity to speak to him about his open letter and the small businesses he’s fighting for.

Why did you decide to step up and be the one to ask for this?

At Countingup, we partner with hundreds of accounting firms so we’re in conversation with accountants all the time. What we heard, up and down the country, was that accountants were incredibly busy. They were being inundated with queries from clients.

We didn’t see any of the accounting organisations voicing their members’ concerns. One accountant even told us “I just wonder why the ACCA (Association of Chartered Certified Accountants) is not doing this already”.

So, we decided to survey our accounting partners and write the open letter to give accountants, and the thousands of small businesses they represent, a voice.

How are people who are not eligible for JRS or SEISS impacted? Have you heard any stories?

Yes, we hear them all the time. We’re backed by more than 450 accounting firms so we’ve heard what’s happening to thousands of SMEs up and down the UK. We get hundreds of messages from concerned accountants, probably it’s best to share some with you directly…

Here are just few snapshot examples of what we’re receiving from accountants every day:

Events industries going down overnight

“A client who has lost all of their contracts for the year (events industry – so all cancelled) has no revenue yet, gets no rates support and virtually no employment support. They are in the leisure industry but because they go to the customers rather than the customers coming to them, they lose out on a £25k grant!”

People who put their lifesavings into starting their own business this year

“Could we ask for support for new businesses who do not qualify for loans (no trading history), no furlough options (no PAYE registration in February), and who are trading as limited companies.

I know of three cases where life savings have been invested in fledgling businesses since January and now they have no income, few savings and Universal credit won’t be enough.”

Working from home

“I would like some mention of home-based business that are not eligible for the grants available to businesses eligible for other businesses eligible for small businesses rates relief.”

Reduced pay and zero tips for hospitality workers

“Add that those employed in the hospitality industry will only get 80% of basic pay as gratuities are excluded. These represent an average of 50% of pay.”

No access to cash is destroying small businesses

“This unprecedented crisis in recent times demands immediate support of Government to halt the collapse of SMEs and social-economic stability, without access to funds most businesses will be irreversibly destroyed. “

And what will happen if these needs are not met?

Many, many businesses will go bust.

Why isn’t the UK government making more use of its extraordinary fintech sector?

I don’t really know what the government’s thinking is here, but I do think that a fintech is more likely to take action, like we did with our open letter. Can you imagine a high street bank ever doing that and surveying its customers and publishing a letter that took a stance on an issue?

Fintech is becoming more political … is the face of fintech changing?

Fintech to me is simply innovation in finance. Innovation is all about looking at things differently or in a new way.

So, whereas the high street banks are notoriously poor for customer service and slow to do anything, fintechs are able to take an approach of delighting customers from the beginning and providing customers with new approaches to business, finance and managing admin.

Do you think that it’s in the nature of fintechs to be problem solvers? To be the defenders smaller businesses and entrepreneurs?

Our mission at Countingup is to make it easier to run a small business. Right now, it’s incredibly hard for businesses. Of course, our main focus is reducing the admin of running a small business with our banking and accounting app, but if there are other ways that we can flexibly use our resources to make a difference then we will. That’s why we also launched an SEISS calculator on our website so sole traders can work out what grant they are eligible for and therefore plan accordingly.

Tim Fouracre is not the only fintech visionary to be standing up to government in this time of crisis. Also battling to keep small businesses alive is CEO of Tide Oliver Prill, who published a letter of his own “Re-open small businesses first!” on the 27th of April. Like Fouracre, he’s fighting to convince government that small businesses need to be prioritised. Complementing the movement is godfather of fintech Nick Ogden, Founder and CEO of RTGS and inventor of e-commerce. Ogden has created a platform which allows alternative lenders to offer government-backed loans to small and medium businesses. It aims to spread the distribution so that banks can cope with demand and fintechs don’t waste their capabilities. Like the others, he’s left in the lurch … waiting for a government response.

So where is our famously business-first government? And why has fintech been marginalised, when it’s made up of some of the most financially astute problem solvers of our nation?

Small businesses need help now. It’s not a drill, these are real livelihoods. The kind of people who build up a business from the ground are brave. They’re determined, hard-working and ambitious. They’re often the kind of independent people who get on with jobs, solve problems and don’t ask for hand-outs. But right now, they need help. Unlike the members of government supposedly serving them, they don’t have a reliable salary. How much of ministers’ pay comes from the 5.9 million SMEs? Government needs to sit up and listen to our proactive fintech leaders as they fight to preserve Britain’s small businesses.