Updated: Jun 29, 2022

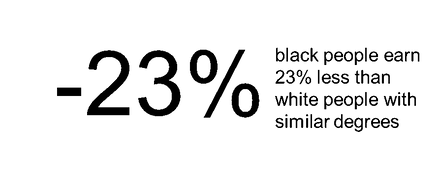

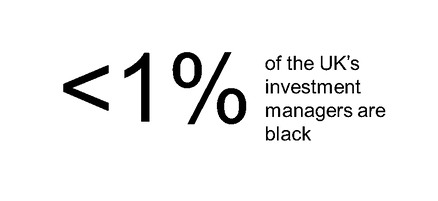

Across England’s schools, black girls get better grades than white boys[1]. But life after the classroom is not so rosy. People of colour are not represented across positions of power. Nowhere is this starker than in the wealth management industry, where less than 1% of investment managers are black[2].

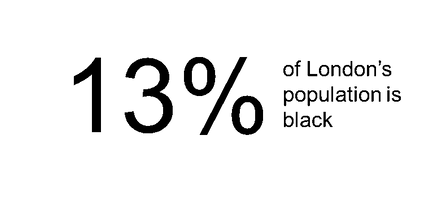

This figure should be at least three times higher. Across the UK, 3.2% of workers are black[3]. In London, the heart of the UK’s booming financial sector, 13% of the population is black. So, what happens between the school room and the boardroom?

In wealth management, there’s an uncomfortable racial truth which The Investment Association call the “blocked pipeline”[4]. Black people can access junior roles, but do not get to progress to senior positions.

Wealth managers are not prioritising diversity in the workplace[5], but this needs to stop, now. Everyone – no matter their ethnicity – needs to step up and do more.

Pulling together a series of articles, statistics and opinion pieces, here are five things that each of us in wealth management should be doing every day:

1. Recognise that “diversity” is not just about gender

If a team is all-white, it’s not “diverse”. This applies to senior teams, just as much as junior teams. Frustratingly, many wealth managers have their own definitions, often focusing around women in the workplace, and not race.

In one study, a black employee commented,

“Replacing a middle-aged white man with the sort of woman he would naturally marry doesn’t change the status quo.” [6].

We need to acknowledge that ethnicity is an essential part of diversity. If our teams are all-white, we can’t tick some box and call it “diverse”.

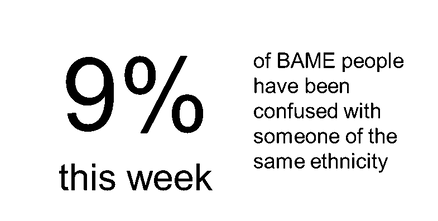

2. Be aware of what’s going on, listen to people

We need to pay attention to the way our black colleagues are treated and check our own behaviour.

“Just because you can’t see racism around you doesn’t mean it’s not happening. Trust people of color’s assessment of a situation[7]”

Kesiena Boom, 100 Ways White People Can Make Life Less Frustrating For People Of Colour, VICE, May 2020

“There are times when I’ve been mistaken for somebody else,” one attendee said, “whether that’s doing tech at a conference or a janitor. Partly this is down to the lack of people making investment decisions who are black.”

Anonymous black investment manager, Black Voices: Building black representation in investment management, June 2019

“I’m regularly assumed to be someone else,” says Justin Onuekwusi, head of retail multi-asset funds at Legal & General Investment Management. “Less than six months ago, somebody thought I was a security guard – and that has happened a number of times during my career.”

Justin Onuekwusi, Slurs and stereotypes taint asset managers touting diversity, September 2019

3. Check corporate images and language

From video game characters to TV experts[12], black boys and men are vastly underrepresented in the media. There’s just one area where black men rule the roost, reveals one study, and that’s in portrayals of crime and poverty[13]. Experts have unveiled a huge gap in media when it comes to portraying black men’s lives and stories[14]. This fuels the racist fire more than you might imagine, and ingrains negative stereotypes into our thinking.

As wealth managers, we need to step up and buck the trend. Make black men the face of our investing products. If anyone tries to prevent this, call them out. We all have a role to play. Email marketing teams if black men are not represented and demand an explanation. If they give you an answer like, “it doesn’t resonate with our clients” or “it doesn’t represent who our clients want to see”, challenge it, fiercely.

In my career, I’ve refused to crop people of colour from sales pitches. I’ve also been called out for not having enough black people in corporate brand images. These conversations (both sides) were uncomfortable, embarrassing and essential. We need to do this[11]. All the time. Until we get it right.

Changing images on a website takes just a couple of minutes, but the effects can last a lifetime.

4. Use contextual recruitment

Everyone loves a rags-to-riches story. Especially in wealth management, where photocopying boys ruled Wall Street with their quick wits, rather than family ties. They may not have had Harvard degrees, some of them probably couldn’t even spell Harvard degree, but they were smart. And they got the job. That’s contextual recruitment.

Sadly, this trend hasn’t really continued, and wealth management has started to become the elitist thing that it rebelled against. Russell Group degrees and internships that have the whiff of “I went to a private school” or “daddy’s got friends” are the new normal.

The Investment Association have highlighted how this approach is detrimental to people of colour[15]. Our socio-economic context makes a huge difference to our school grades[16], and inner-city black children may need to work much harder to achieve the same grades as their white counterparts.

Remember that universities like Oxford and Cambridge forbid students to get jobs. How many 18-year olds can really afford to pay tuition fees of £9,000+ a year, as well as rent and living costs in these expensive cities? Think twice before you take on an Oxford graduate with an internship, over a polytechnic graduate who’s paid the rent by working in a bar. Sometimes three Bs in an inner-city school is worth more than three As and a gap year. Sometimes a CV showing late shifts in fast-food outlets is more impressive than doing an unpaid apprenticeship at a private bank.

5. Get clear data and targets

What’s the first step to planning a strategy? How do we pick and choose investments?

We research. Like crazy.

In wealth management, we have entire teams of researchers, analysts, forecasters, quants and more. We all know that it’s stupid to make decisions blind.

So … why would this be any different? Diversity is more important than dividends. If wealth management approached non-discrimination the same way it approached profit, there’d be no problem.

Getting a handle on the real data and coming up with some clear Key Performance Indicators is essential. If you want to introduce mandatory ethnicity pay gap reporting, you can sign this petition.

UK wealth management is the second largest in the world, if we can manage £7.7 trillion, why can’t we manage to put more black people in senior positions? I’ve laid out five points which could make a difference. For a much more in-depth plan, I urge you to read this white paper and share with your co-workers: