Money2020 is where you discover what you’ll be writing about next year. Seriously. Some of the concepts are so new and abstract that you wonder if you took a wrong turn into one of Amsterdam’s more elaborate coffee shops. After all, where else do ex-bankers in t-shirts chat to you about the magic of Web3? Or Europeans with edgy haircuts debate “fraud in the cloud” with croissant-holding investment managers? It’s a techy kaleidoscope of finance meets future.

If you’re brain hasn’t been squeezed, mulched, and splatted by around 11.30am… you haven’t been listening properly. 🤪

Amélie Arras and me messing around onstage!

Here are six mind-bending conversations from last year, which are smack-bang in the spotlight today.

1. Crypto’s carbon footprint 🤑

Surreally, last year’s Money2020 had a “Sex, Drugs and Rock n’ Roll” stage. If it was called “Sex, Drugs and Harass an Intern” I think a lot more investment bankers would’ve showed up!

Anyway, I wasn’t sure what to expect. But to my great relief the content was less about old men prancing in leather and more about decarbonising crypto.

Leading expert and advisor Kirsteen Harrison (for decarbonisation, not old men in leather*) took to the stage to explain what was going on. She revealed how there is “quite a lot of polarisation around the debate of crypto currencies”.

“They usually compare the energy use of crypto to a country”, she added. “Which is an … interesting … way to quantify it”. It’s true that a lot of people (including me) have a big stick up the butt when it comes to carbon emissions and digital currencies. The main offender is Bitcoin. It’s SO carbon intensive and STILL the world’s favourite coin. Gahh.

But Harrison was keen to move beyond this old debate. She believes it’s time to look at other less carbon-intensive coins and the power of blockchain technology.

(BTW I recently learned that Bitcoin was never supposed to be a currency, check out my 32 mind-bending nuggets here).

“If we cannot get past this Bitcoin number”, Harrison eye-rolled. “We risk not allowing a very serious sector to reach its full potential… Crypto and blockchain are entirely compatible with the net-zero strategy”.

Fair point. Well made.

Today, the sustainability and feasibility of digital currencies is taking centre-stage, as governments around the world consider minting their own Central Bank coins. As everyone’s favourite old guy in leather Mick Jagger would shriek and wiggle, it’s “hot stuff”. 🔥

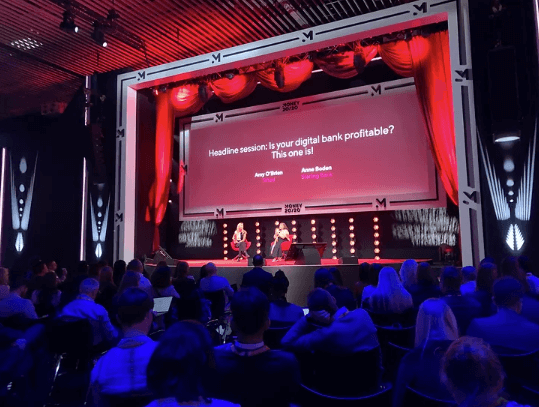

2. Sage business advice from Anne Boden 🙏

Anne Boden. What an icon. She’s the straight-talking, shawl-wearing, shoot-from-the-hip CEO of Starling who’s out for profit.

A highlight of Money2020 was getting to see Boden herself onstage and even bang out question. Lush. Today, as I read that she’s stepping down (NOOOOOO!!!!), it feels even more of a privilege to have seen her in action.

Boden offered meaningful advice to founders about how they should approach building a bank. Since this talk, VC funding has tightened a lot and the competition is reaching boiling point, so her recommendations are even more valuable. Go Boden!

“There’s a huge difference between fintechs that are profitable, and fintechs that are not”, she lamented. For her, having clients who stay the course means everything.

“We decided to go after the customer segment where they would bank with us as their main bank”, Boden explained.

Boden advised founders to go for “quality over quantity”. Sage words of advice, especially in these rocky times!

3. Buy Now, Regulations Later…? 😬

Buy Now Pay Later (or “what Klarna is” to most people) was just coming into fashion around the time of last year’s Money2020. It was a weird one. Made for a few awkward silences. While the finance world was getting giddy about the opportunities ahead, charities and NGOs were warning about the risks. And there were a LOT of risks – especially for young people.

One talk which covered this topic sensitively was a panel called “What’s next for BNPL?”. One of the speakers was Go Fund Yourself’s Alice Tapper who really stood up for vulnerable consumers. I love her.

When confronted about the benefits of BNPL Tapper fired back, “Many people are not using BNPL in that way… Retailers are in a very unique position and retailers need to be called into line!”. BAM!

The regulators seemed to agree, and over the subsequent months they got to work creating laws to close the BNPL loopholes.

At the time of writing, the UK legislation has already been drafted and is now in the consulting phase.

Once again, Money2020 is on the money! KaPOW!

4. Ethical AI is a big deal 🤖

OMG. Do you know how many commissions I have around ethical AI right now? I’ll tell you. Three. Two thought leadership articles that I need to ghost-write ASAP and one white paper plodding along in the background. It’s a burning hot topic. I feel like the paper is hissing and steaming as I write.

The launch of ChatGPT unleashed a tirade of ethical AI questions. In the US, Democrat Ted Lieu revealed that he was “freaked out by A.I., specifically A.I. that is left unchecked and unregulated.” He’s already drafted legislation to “ensure that the development and deployment of AI is done in a way that is safe, ethical, and respects the rights and privacy of all Americans”. But that’s nothing compared to lawmakers in Italy, who temporarily banned the platform earlier this year.

Ethical AI is about to evolve, evolve and evolve again like a Pokémon on steroids. Everyone’s talking about it. But who talked about it first? For myself, the first panel I ever saw on this topic was at last year’s Money2020.

“Is ethical AI part of your company goals?”, Onfido’s brilliant Mohan Mahadevan quizzed the audience. “Ask your organization these questions!” Mahadevan spoke to my soul about the importance of eliminating bias and protecting privacy in AI.

“The spirit of ethical AI should not be missed”, he stressed. “It’s not just ticking a box”.

Mahadevan challenged the audience to develop “neuro-symbiotic” AI to enhance the life of everyone. Good word, right? If only Microsoft had been in the audience, the company could have swerved some major data privacy headaches.

5. Embedded Finance changes everything ✨

There is a bright orange book on my shelf written by Scarlett Sieber and Sophie Guibaud. When my clients see it, their eyes light up. I can see that they are willing to trust me.

That’s because it’s the definitive book on Embedded Finance, the hottest trend in the industry since the launch of credit cards.

Embedded finance is more than an Amsterdam coffee-shop moment. It’s the kind of industry-bending concept that’s closer to Jefferson Airplane performing at Woodstock in 1969. The technology is transforming and morphing the way that finance operates entirely.

Imagine this… Banks will not be consumer-facing anymore. They’ll be basically B2B. Your bank could be your social media platform or mobile wallet. Finance will be a one-stop-shop at the checkout. Not just the online checkout. Physical too. Everything from insurance to lending will be tailor-made for your purchase and you’ll be offered it before you even realise you need it. The mindf**k of embedded finance is so steaming hot that it’s making everything else look wibbly. You will never need to type in your long card number again, we might not even have cards.

OF COURSE…. My hardback has a massive “Money2020 LAUNCH COPY” sticker at the front… Because that’s where I got it! While the rest of the world is just catching on now, Money2020 was one of the very first to grasp onto this exciting concept and introduce it to attendees. We even got beer to refresh us while we read!

Money2020 – The Fintech Whisperer? 🧙♀️

Once a year we all pile off to Amsterdam and brace ourselves for some heavy-hitting fintech. The people who are literally inventing fintech are sat in the audience and talking onstage. The event is kind of a fintech whisperer. But kind of not, because Money2020 IS fintech in action. It’s all the brains gathered in one massive place coming up with ideas together. The founders, the scale-ups, the big banks, the icons, the Steve Jobs wannabes, people who call finance “sexy” 🤢 and the soon-to-be-fintech-famous… They’re ALL there. Mostly.

Can I afford the train to Amsterdam? Probably not. Can I afford the hotel? Strong no. But I will scrape out the last dregs of my sorry-looking account to get there because it’s where fintech moments are made!

PS. If anyone wants a write-up of the event, please reach out – I’ll swap you an article for a place to stay! Not joking. Message me!