The US dollar is famously the world’s reserve currency. Which benefits the country ENORMOUSLY. Or as Charles de Gaulle so eloquently put it back in the day, the US dollar has an “exorbitant privilege”.

The dollar plugs a huge power gap. Firstly, the USA can borrow a lot more than other countries. Secondly, international trade keeps the dollar in demand. But as the dollar becomes problematic, the world is considering a potential new reserve currency: the euro.

The euro has been steadily gaining popularity for a while now. Which is a real threat to Americans because if the world switched to a different reserve currency – or at least, relied less on the dollar – the USA could plunge into economic disaster.

Today the dollar represents 59% of the world’s reserve currencies. Almost triple the euro, which makes up just 20%. (The other major currencies are the Japanese yen at 5% and the British pound also at 5%). Without doubt, the dollar still takes the crown.

The dollar reserve currency is a lifeline for the USA

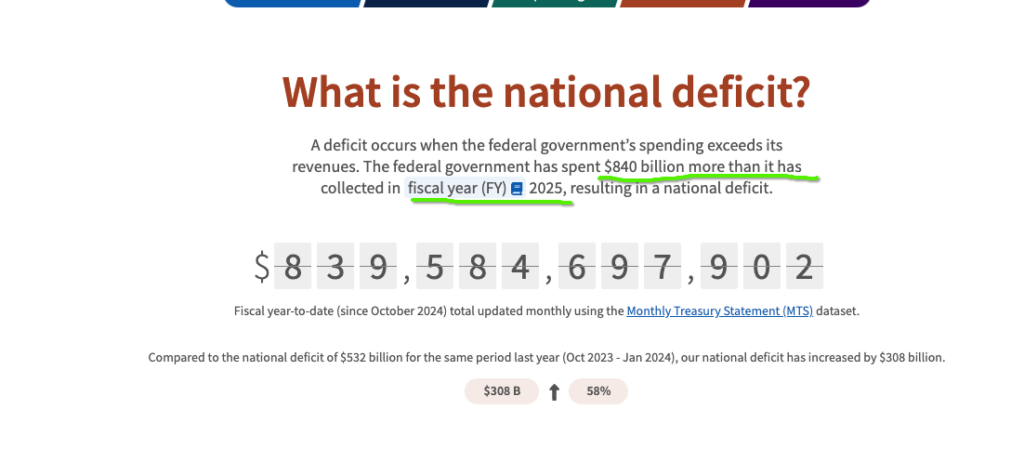

However, that could be about to change. Because for two decades now, the USA has got itself in a real pickle when it comes to debt. The country is spending more than it gets back in taxes. A lot more. The government spent $7.65 trillion in 2024 alone, but it only collected $4.92 trillion in taxes, resulting in a $1.83 trillion debt.

In the words of CFA institute: “the US federal government has been running budget deficits uninterruptedly over the last 20 years”. Already this year, 2025, at the time of writing, the US government has spent $840 billion more than it has. And it’s March.

As you can imagine, this has an impact on the value of the dollar. And the world’s central banks are getting tired of it. About half of the dollars in circulation are stored in other countries. Literally, “reserve” currency.

Commodities like oil are sold for dollars. And then all of these oil states are bummed out because the dollar becomes worth less and less, as the USA loads up on more debt. Imagine if your mate kept overspending and then you were the one who got the hit in your bank account. Now imagine if it wasn’t even your mate.

To add insult to injury, one of the USA’s favourite ways of paying back debt is to just print more dollars. This obviously creates inflation. Not for the USA though… for everyone else.

The international demand for dollars (to buy commodities like oil) pushes the value back up. This means that other countries get burned twice. They’re paying more and their reserves are worth less. But the USA gets a strong dollar, cheaper imports and as much debt as they like (theoretically at cheaper interest rates too).

Bit selfish, to be honest.

It’s got so bad now that the reserve currency has become a lifeline. A life machine. The USA would probably cease to become the world’s most powerful country without it. It’s kind of an open secret.

The euro is a direct threat to the USA

Economists know that the dollar is being propped up too much by international demand. More than three quarters of financial analysts (77%) think that US finances are unsustainable. It was a big talking point at Davos this year. “Both parties in the United States seem to think that debt is a free lunch,” said Harvard economist Kenneth Rogoff.

If the dollar wasn’t the reserve currency, it would be plummeting, potentially taking the USA down with it. Export counties are getting a bit annoyed that this is happening. After all, it’s eating away at their profits.

Every so often an oil tycoon will have a go at switching to a different currency. Here’s what happens. After 20 years of trading oil in dollars, Saddam Hussain changed to euros in the year 2000. Two years later, he was overthrown and killed by the USA. After 40 years of selling oil in dollars, Gaddafi floated the idea of switching to gold dinars. Same story.

Around the time of 2016 ish, Iran started to talk about moving to euros. In 2018, the country decided it was the best course of action for their economy and values. Let me just check the news…

Operation: Destroy the euro

Ok, so there is a large and looming threat the dollar will cease to become the world’s reserve currency. Only a third (34%) of global financial analysts think it will stay the same over the next 5-15 years.

The most obvious rival is, of course, the euro.

So, if you were a politician tasked with running the USA (or a billionaire, scared about losing your wealth), what would you do? You know that if the dollar ceases to become the world’s reserve currency, the country would plummet into an inflation and debt crisis. Plus, the USA relies quite a bit on exports, which would become super expensive. Capitalism would collapse. The US empire would fall. All those billionaires would have to kiss goodbye to their government contracts. Dollars would rapidly become worth cents.

You would try at all costs to keep the dollar as the dominant currency. Aggressively. Find reasons to crush down anyone who tries to switch to the euro. (Drumming up some Islamophobia and stories about nuclear weapons works well). Cosy up to oil states, and refuse to release your vice-like grip on them.

And, you destroy any rival currencies.

But how do you obliterate the euro? How can you shatter the strength and reputation of a currency backed by 27 states?

Well… you try to break them apart, right? Hellllloooooo fascism!

Promoting nationalism and facism to weaken the euro and strengthen the dollar

Why is the Vice President JD Vance trying so hard to uplift Germany’s extreme right neo-nazi group, AfD? He came to Europe, shouted at the democratic leaders and then went off to dinner with a fascist political group.

Why is billionaire and government contractor Elon Musk using his platform X (formerly Twitter) to promote extremist far right groups in Europe? He’s even attended AdF rallies. Why did he do a nazi salute on the world stage? Why is meddling so badly in European elections? Why is he trying to spark a civil war in the UK? He’s even willing to risk Tesla sales for it. What’s at stake for him?

Why is Donald Trump so happy about Brexit? Why does he promote far-right nationalist Nigel Farage?

There is a clear incentive for USA politicians (and billionaires) to create divides in Europe, so that world leaders don’t perceive the euro as a more reliable reserve currency than the dollar.

Europeans are at a juncture: Divide and get weaker or unite and maybe become the new reserve currency?

The truth is, switching to a new world currency wouldn’t be that difficult. The only reason that the US dollar is the reserve currency is because 44 of the world leaders sat down one day in 1944 in Bretton Woods, New Hampshire and agreed to it. They signed a thing.

The second world war was on its last legs. Nobody really had the means to carry on with the gold standard. So, to rebuild their countries, they decided on a trust-based system. They would create central banks and base their currencies on the value of the US dollar. Dollars were like the new gold.

Two decades and one year later, an extremely grumpy Charles de Gaulle would deliver his blistering attack on the new reserve currency system.

“The fact that many states accept dollars as equivalent to gold,” he said, “In order to make up for the deficits of [the] American balance of payments has enabled the United States to be indebted to foreign countries free of charge. Indeed, what they owe those countries, they pay … in dollars that they themselves can issue as they wish”.

Which brings this blog full circle, back to the introduction (love it when that happens).

Could a new Bretton Woods take place?

Maybe. Practically, it’s very simple. You just need enough heads of state to sign it. The EU has 27 member states, the handful of EEA countries, the UK, Canada might be keen…

BUT geopolitically, it would be super risky. Because with nothing to lose, the USA would roar, and unleash its full power. I mean, it would be fight or die for the USA. So, it would try to pummel the other countries back into keeping dollars as a reserve, right? American politicians can’t get enough of being the most powerful country in the world. They would freak.

So, this blog doesn’t have any answers. But one thing I guess I would like to say is… the billionaires and politicians who are stoking far-right fascism and protectionist policies in Europe are doing it for themselves. Not for us. They want to protect their dollars at any cost. Whatever happens, whatever the reserve currency, we are stronger together.