“Streamlined” is how Kibo Ventures’ co-founder, Aquilino Pena describes today’s funding environment. We’re at Barcelona’s bustling Mobile World Congress. He’s onstage, talking in a panel. I’m on a plastic chair in the stalls, furiously scribbling notes. “It’s been a hard year in terms of fund management”, Pena adds. After the $195 billion highs of Q3 2021, global VC funding tumbled down to $74.9 billion by Q4 2023.

The panel can hardly be heard over the background noise. Thousands of start-ups clamour for attention in the hall outside, fighting for their financial lives. The competition is fierce. “The quality of the founding teams has been very high”, acknowledges Pena. “Because they are used to working with less money, they are more capital efficient”.

With limited funds and soaring expectations, today’s venture capitalists (VCs) are laser-focused on what they want. Here’s a run-down of what’s white-hot… and what’s hella NOT in tech today.

🔥 On the HOT list 🔥

Easy tiger! This section is so piping hot, it will leave you blistering all over.

👉 One-stop-shops for B2Bs

Early-stage venture fund, Notion Capital is keen to invest in consolidated business-to-business (B2B) platforms. Partner and panellist, Itxaso Del Palacio highlights how companies, like cafes, might only have three employees, but “52 SaaS” (software-as-a-service). She’s on the lookout for promising start-ups that simplify life for SMEs with one-stop-shop solutions. This could include, for example; accounting, business banking, invoicing, supplier orders, email outreach, content marketing and more … all on one platform. In her words, it’s about moving beyond “banding SaaS” and towards “operating systems”.

Getting a market share would be extremely lucrative. In the UK alone, 900,000 new businesses started last year, a 12% increase on 2022. By 2028, the local SaaS market is expected to surge from $12 billion to $19 billion, leading the way in Europe. But that’s nothing compared to India. According to joint research from Google, Bain and Temasek, e-commerce is projected to grow sixfold by 2030, to $900+ billion. Along with it, India’s B2B e-commerce is expected to multiply 14 times, while the SaaS market will grow five or six-fold to around $70 billion.

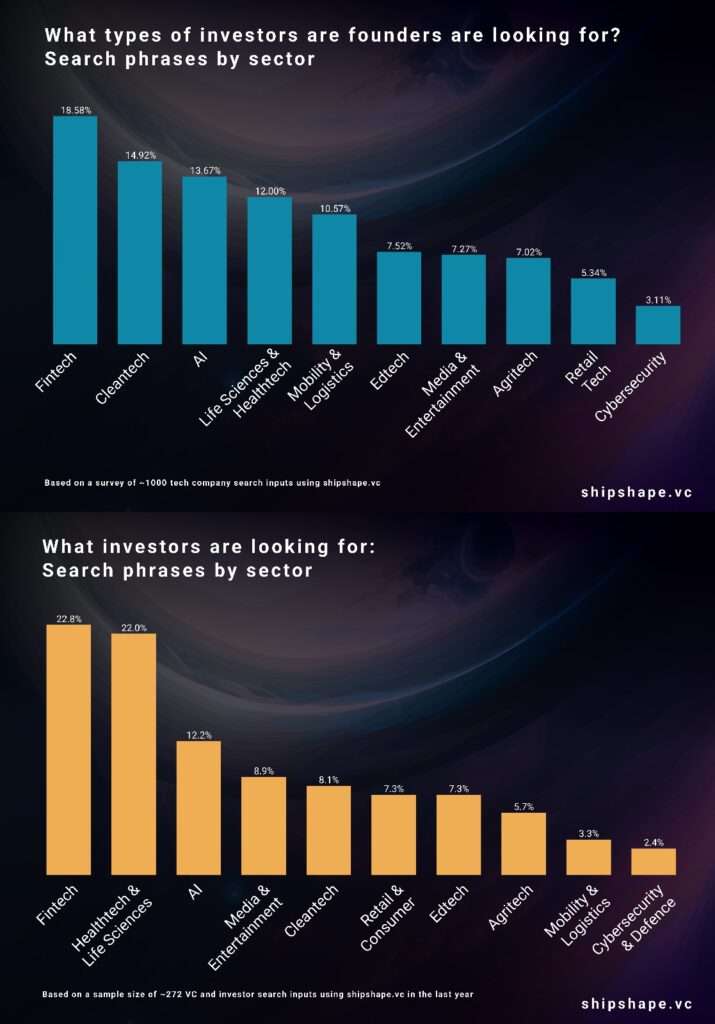

A huge part of SaaS, is of course, fintech. Banking-as-a-Service (BaaS), Payments-as-a-Service, Lending-as-a-Service… Fintech continues to be a hot topic for VC investors and start-ups alike. Although, it could find itself becoming increasingly mulched into one-stop-shop platforms.

👉 Cleantech

Data from KMPG shows “all regions have shown interest” in cleantech. As the world heats up, so is the interest in cooling it down. “We like climate. A lot”, emphasises Pena. For Kibo Ventures, tech which measures adverse weather risk, is especially appealing. Accurate risk assessments will be industry-saving for insurers, as 2023 saw a record breaking 37 climate events leading to billion-dollar payouts. Tensions have flared as current risk modelling systems are not up to scratch.

Cleantech solutions are vast and creative. As of Q4 2023, some of the most popular include small scale nuclear fission technologies, decarbonization technologies, biodegradable packaging solutions and alternative meat products. Interestingly, big tech like Microsoft are even buying up thier own nuclear power plants to fuel net-zero datacentres.

However, the supply of cleantech could be overreaching demand. Daniel Sawko runs Ship Shape, a specialised search engine connecting founders and VCs. Among the 272 investors using his site, only around 8% are seeking cleantech opportunities. By contrast nearly 15% of 1080 start-ups are cleantechs, hungrily looking for investment. Standing out in this market will be difficult.

👉 Women founders

Isabelle Gallo left her job at Breega six months ago to set up SISTAFUND. At this VC, there is one golden rule, founding teams must have at least one woman. “There’s not one study that doesn’t show that diversity drives performance”, Gallo explains. Across a sample of 1,265 companies, the latest research from McKinsey found that those with gender-diverse executive teams outperform by 39%. For Gallo, diversity is a low-hanging fruit to deliver better returns for investors “the maths are pretty simple”, she shrugs.

EY data from 2022 reveals 40% of early-stage start-ups in fintech are founded or co-founded by women, so there is no shortage of options. But the majority get overlooked, as just 15% go on to get any funding. Research from the UK Treasury found that for every £1 of funding, just 2p goes to all-female founders, and 14p to mixed teams. The remaining 84p is poured into all-male start-ups, even though data suggests these companies will be less profitable.

Diverse teams create products for overlooked consumers, filling lucrative market gaps. “The female consumer sector has been underserved”, elaborates Founder of Iris Ventures, Montse Suarez. Like SISTAFUND, Iris Ventures is part of a growing trend of VCs, who seek diverse teams, diverse products and “purpose-driven founders”.

👉 Healthtech

Another swelteringly hot investment topic is healthtech. With employer health insurance costs jumping 8.5% this year in the USA, and NHS waiting lists crunching to a halt in the UK, quick solutions are high in demand.

According to Ship Shape data, 22% of investors are searching for start-ups that specialise in healthtech and lifesciences. However, just 12% of start-ups offer this service. Is there a lucrative healthtech-shaped gap in the market? Sawko seems to think so. “It’s a really expensive problem, which means that if you solve it, there’s lots of money in it for you”, he adds.

👉 Hardware

The past decade has been all about getting off mainframes, and into the cloud. Hardware was considered a bit cringe, even. But looking round MWC, it’s making a comeback. “We’re hitting up against like the physical limits of what the computer chips that we’ve created today can do”, elaborates Sawko. The global microchip market today is valued at around $80 billion, and it’s anticipated to almost double to $157 billion by 2032.

From tiny chips that balance on your finger, to colossal data centres filling entire fields, hardware is taking many forms. The worlds of Web3, cleantech and cloud computing are colliding, creating new machines along the way.

The start-ups that produce powerful new homes for our ever-growing computations could be in for a treat. Interestingly, Wales already produces 55% of the world’s compound semiconductors, giving the nation a head start in the race.

💩 On the uuuhhh… NOT list 💩

What makes VCs go “meh” and turn the page …

👉AI without a use case

Interest in Artificial Intelligence (AI) cooled over the past twelve months. Now that the ChatGPT hype has simmered, tech for tech’s sake is out. “It’s really the use case that matters”, elaborates Pena. Seaya’s Aristotelis Xenofontos agrees, adding “product beats technology”.

Sawko feels that AI has become less of a competitive edge, and more of a generic must-have. “Everyone’s got their nominal AI slides”, he says, but it no longer hooks investors like it did a few months ago.

👉 Small funding rounds

VC firms like Notion are not interested, “unless you’re thinking of building a unicorn”, explains Del Palacio. She’s looking to make big returns.

Ship Shape’s data suggests the same. “If you’re raising between nought and half a million [pounds], there aren’t that many funds that play in that space because they’re quite small deals”, Sawko explains.

This, he believes, is where a lot of start-ups are getting stuck. For founders with experience, he encourages them to consider asking “for more money, and you’ll potentially have more buyers”.

👉 Mmm…. Crypto and NFTs…?

Over the past few years, the NFT hype has waned, and now the number of VC funds is “niche”, according to Sawko. None of the VCs panellists mentioned tokenisation, suggesting that the craze has cooled. That said, with central bank digital currency bubbling, and blockchain evolving, it seems unlikely that the dip will last long.

🤔 My view…🤔

Ok so I’m no VC, but I do talk to investment managers all day for a living. In my opinion, the tech companies that will shine brightest will be the ones who can balance out other areas of existing portfolios or fill some gaps, while providing profit. Like right now, for example, banks should be frantically trying to decarbonise their books and fill them up with nature-positive solutions instead. Because regulations are coming and its going to get expensive to hold so many high-emitting assets. I’m not necessarily talking about things which offset carbon, because honestly, that market is already oversaturated. I’m thinking like regenerative farming.

The commodities market is going through hell because farmers in Africa can’t cope with increasing weather events, plant diseases and soil degradation. Just look at cocoa prices. So, anything which can help revitalise the planet, while providing a useful service looks good. We’re kind of moving beyond off-sets right? Like honestly, whatever. Paying to pollute sucks.

Now its more about the circular business models, and heading towards societally beneficial enterprises. So that’s my two cents! For what it’s worth, I also think that AI will get a makeover and we’ll see less of the cheap content, and a bit more of actually useful stuff like filtering out fake news.