The concept of sustainability, derives from the Latin verb ‘sustinere’, meaning ‘to hold’. And like its ancient namesake, it’s not a new thing. Believe it or not, it’s been going on for centuries. Even as far back as 1592, a Bavarian law was put in place to protect trees from deforestation.

How Victorian virtues and religious rules shaped impact funds

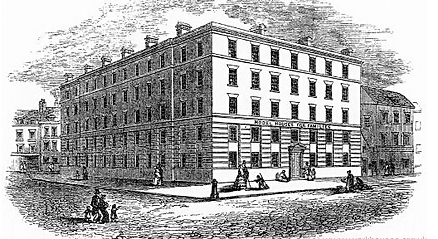

The start of the industrial revolution was a bit of a gloomy time. Think of the Victorian Age and it’s hard not to conjure up Jack the Ripper, workhouses, miserable old widows, factories, slums and sotty air pollution. However, something else began to emerge too, “philanthropic investments”, especially for safe housing for workers. Today, that would probably fall under the category of “Impact Investing”, which is the type which tends to make the most positive change.

There’s relatively little known about these early investments. But hidden within crumbling newspapers there are hints.

For example, in 1841, the Peabody Trust began raising investments for the Model Dwellings Companies, with the aim of “Providing the labouring man with an increase in the comforts and conveniences of life, with full return to the capitalist” (Lohin, 2017).

There are other niche forms of Sustainable Investing dotted around the 1800s too. Some of them sprung from religious groups such as Quakers, Methodists and Muslims (Junkus and Berry 2015, Donovan, 2019). These ethical investments toed the strict moral guidelines required of its congregations. And for some religions, it’s still going strong today. Islamic finance is worth an eye-popping $2.7 trillion worldwide, and there dedicated new fintechs and neo banks popping up left, right and centre.

Check out my Virtual Arena interview here with the founder of Islamic neo-bank, Insha

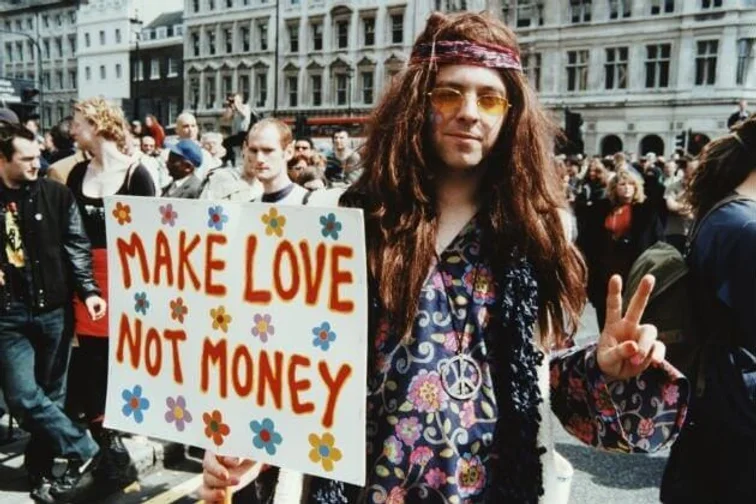

Peace, Love and … Investing? The start of negative screening

The two World Wars and Vietnam War left a lasting and traumatic impression. By the 1960s, people had had enough and started to rebel against the way things were done. And this included investing. Students at Harvard protested against the way that their fees were being invested by the university, they wanted none of it going to armament or South Africa’s Apartheid. These people-first protests gained momentum across the U.S.

Over time more and more institutions bowed to pressure and stopped investing in “bad things”. Today negative screening generally excludes weaponry, pornography, tobacco and gambling. Some managers have added in additional screens, for example against unethical working conditions, non-diverse boards or animal cruelty.

At the time, negative screening was ground-breaking. But today, when we talk of Sustainable Investing, it’s kind of the minimum you can do. It’s like seeing a box of abandoned kittens and not kicking them. Negative Screening is not saving the world, it’s just destroying it less. Some wealth managers prefer to call it different names like “Sustainable Investing” or “Ethical Investing” … but don’t be fooled!! Read the small print.

Negative screening can also be called “Responsible Investing” or “SRI Investing”, but not always.

Read more about the hot mess of Sustainable Investing naming here.

Negative screening sparked the next big milestone for Sustainable Investing … the rise of ESG!

Baby boomers created ESG in the 70s and 80s

The idea of Sustainable Investing which challenges classical economic theory began to emerge in the 1970s. Up until this time, it was always assumed that an investment just needs to make money for the investor, and nothing else was needed. What the economists forgot about is that humans are not rational. We’re not just motivated by money, we have other things we care about too. So there!

The outcry against bad investments had ignited a new idea. And, just like the first milestone, this next one would also be created by academics… perhaps surprisingly, by leading-edge baby boomers.

The academic “Frankfurt-Hohenheimer Guidelines” was born. It listed 850 criteria for ethical investing. They were created by a clever cohort of economists, philosophers, ethicists and theologians. Grouping all the criteria into three distinct categories, Environmental, Social and Governance, the start of ESG investing had begun!

The first ESG mutual funds were offered in the US in the 1970s. In the UK, we dragged our feet a bit and didn’t offer them until the 1980s. It was one of the first real attempts to define or categorise sustainable investing.

Throughout the 80s, it wasn’t all big hair and shoulder pads. Some people were working hard to change the way we invest too. In 1984, the U.S. Sustainable Investment Forum was founded, referred to today as US SIF. This group was created to bring real change to investments and make sure that they were living up to their sustainable credentials.

The 80s saw the ESG investing come to life. But it would have to compete against the fast-paced, hairspray-heavy lifestyle that was fast picking up pace. This was the time of globalisation, of mass aviation and the likes of Wolf of Wall Street, Jordan Belfort.

This epic battle between consumerism and conscience would continue over the next decades and generations.