Updated: Mar 31, 2023

Ask a child to draw a millionaire twenty years ago, and they’d probably produce a squiggly sketch of middle-aged white man. Most likely, he’d be suited, booted and swinging a briefcase bursting with crisp dollar notes. But that image is fading. Because, at the turn of the millennium, we lived in a vastly different world. A planet that seemed to be healthy. Where cash was king, technology was in its infancy and when it came to finances, men ruled the roost.

High net worth women are striding into the mainstream

Fast forward to today and it’s an almost unrecognisable picture. To start, 40% of US businesses owners are now women, a 114% increase on 2001. And they’re making money. Real money. In 2018, female-owned businesses generated a staggering US$1.4 trillion in sales[1]. Around the world, that figure jumps to around $5 trillion each year, which continues to increase over time[2]. It’s estimated that today more than a fifth of women with $5 million to their name, earned it through their own business.

Millennial women are especially speeding ahead into positions of affluence, much faster than their baby boomer predecessors. Over half of HNW Millennial women created their own wealth, compared to 37% of HNW baby boomer women[3], demonstrating a growing independence. Asset Managers who still think that wealthy women only inherit money need to piss off. Because it’s not a level playing field and we are absolutely smashing it.

Interestingly, it’s not just the SME world that’s getting a boost from women, the number of players in the stock market has grown too. For example, we’re about to witness a tipping point of female traders enter the crypto-market, and the majority are not Millennials. Women around the age of 44 are anticipated to flood the crypto-world soon, according to Gemini research[4].

All these studies are lining up and pointing in the same direction: women are fiercely asserting their financial independence like never before.

A $93 trillion gap in the market

Today, women hold more than 32% of the world’s wealth, and counting. By 2023, women are expected to hold $93 trillion.

What’s more, they make up 15% of the uber-rich ultra-high net worth (UHNW) clients too. The wealth manager that gets it right for this growing group could become extremely profitable, especially as 63% of women are unhappy with their bank’s current value proposition[5].

So, the $93 trillion question[6]: How can wealth managers become attractive to women?

What should banks be doing?

Sometimes, you know, I write my blog and I think “I’d better not write that, because it’s too obvious”. This is one of those times. But I’ll type it out anyway…

Banks need to build products designed for women. Like, d’uh. … Ideally created by women, for women.

So, that doesn’t mean taking a standard portfolio and decorating it with an impossibly young and happy model smiling into the forest.

I’m not talking about the packaging; I mean the substance. Less pictures of women and more investment mandates designed for them.

Investment portfolios need to be built from scratch, with women at the centre. Start with us. Pay a proper agency to do some proper research and start with what we’re looking for. Don’t squeeze us around products built for men. We’re not into it.

Let me give you an example. 64%[7] of women will factor environmental, social and governance (ESG) into their investment decisions. Obviously, the type of ESG varies from woman to woman. For example, I’m OBSESSED with eliminating plastic. Whereas I know other women don’t want to invest in predominately male boardrooms or be involved with any company implicated in sexual harassment scandals. Fair enough! So, the type of ESG may vary, but overall it’s really important to us. It’s not an add-on. It’s the core, and everything else is the add-on.

So, if I was in charge of banks, I would probably start with ESG, and work outwards to create more personalisation. I’ll show you what I mean…

If I was designing investment mandates for HNW women…

Right. So, if I were to create a suite of investment products for women, this is probably what it would look like:

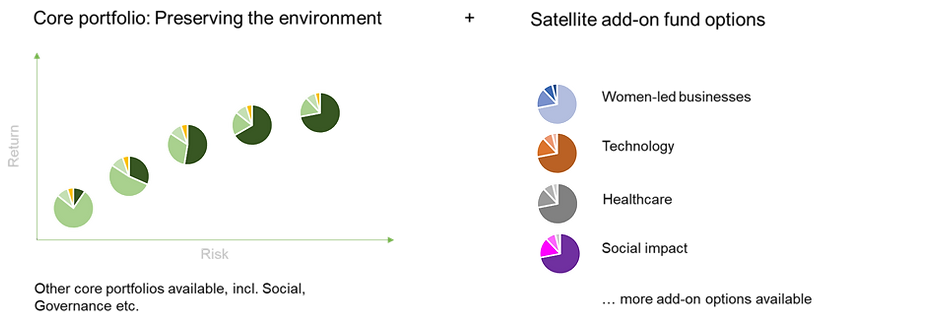

- Choice of Environmental, Social or Governance core portfolio (with different risk levels)

- Optional fund add-ons

EXAMPLE 1

For example, if you chose an environmental core portfolio as your base, it could look something like this:

Pick your risk level. Then select your add-ons. Simple!

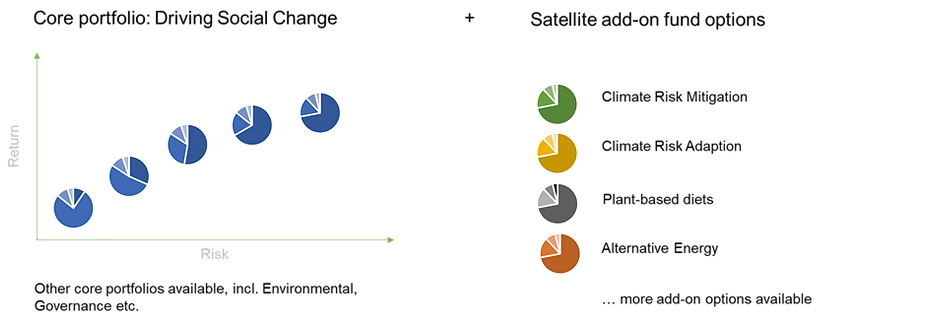

EXAMPLE 2

Or if you selected a social core portfolio it could look something like this:

Same thing. Pick your risk level, then select your add-ons.

What I’m trying to do, is to put women’s investment priorities at the very centre of the portfolio. The beating heart. I’m guessing a bit, of course in real life, these asset allocations would be driven by hard data.

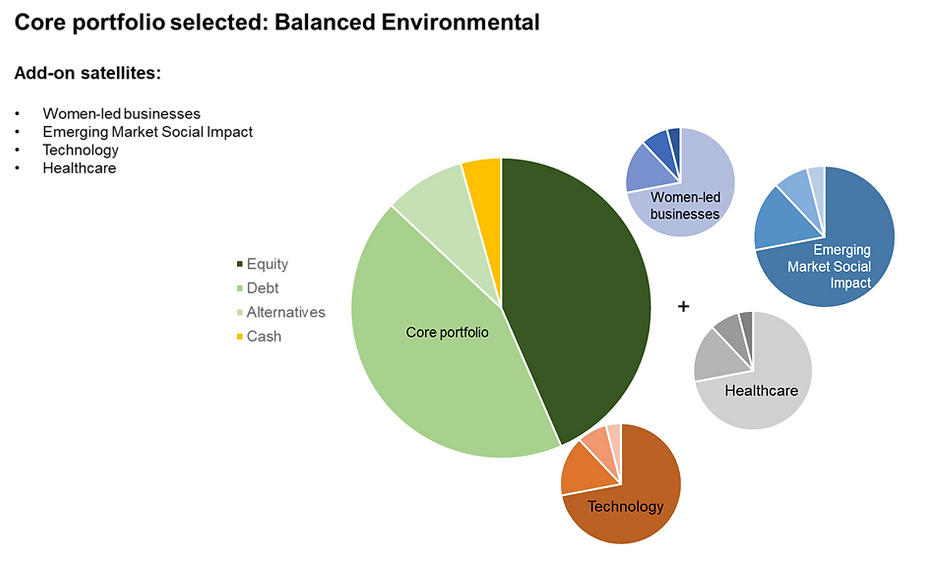

END PRODUCT

The final portfolio would look a bit like this:

This is a balanced portfolio built around the environment, with a fairly equal weighting of debt and equity, plus some alternatives and cash. On top of this core portfolio, four add-on satellites have been selected by the client. These could be funds or other ready-made portfolios could be leveraged. In this hypothetical example, I imagined that our fabulously wealthy lady wanted to add-on women-led businesses, emerging market social impact, technology, and healthcare.

Come on! Give us what we want!

Of course, I’m a writer, and not an investment manager. And so, I’d be amazed if my ideas for women-first investment portfolios didn’t have a million and one flaws. But the point I’d most like to make is that more products need to be built FOR women.

Every day, I get clients asking me for blogs about investing for women. Or ESG for women. But dotting a few articles around or pasting pictures of wistful looking grandmas over products built for men isn’t going to cut it.

So here’s my takeaway for banks and wealth managers: Create products for women and we’ll start looking at them. After all… could you really afford not to?