Updated: Dec 7, 2021

“The race is ON!” These were the words I heard as I squished my way into a packed room, and burrowed towards the stage. But the speaker, Charles McManus, CEO of ClearBank wasn’t talking about dirty latecomers like me, hustling for a seat on the floor. He was bursting into an impassioned speech about embedded finance!

Stop talking, and start doing … Let’s get this revolution started!

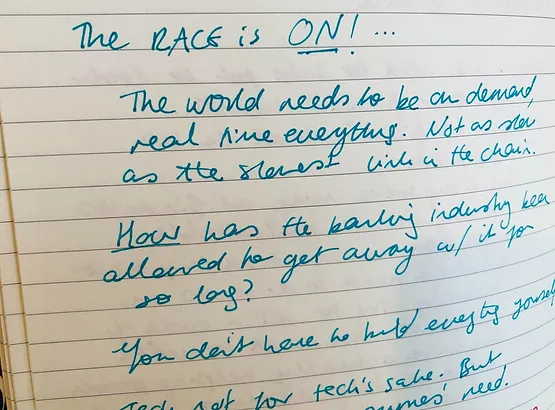

“The world needs to be on demand. Real time everything!“, McManus exploded*. I started writing faster than my fountain pen was designed for. This was right up my street!

“HOW has the banking industry been allowed to get away with it for so long?“, McManus exclaimed. “You don’t have to build everything yourself. It’s not tech for tech’s sake. Just answer the customer’s need!” I wanted to punch my fist in the air and bellow “VIVE LA FINTECH”, French revolutionary-style. But that would have been super awks.

So, like everyone else, I made do with a murmur and a nod. But in my heart, I was parading the streets of Paris with a flag.

It’s not just about the tech! Embedded finance is holistic

But, believe it or not, Charles McManus wasn’t my favourite speaker – even though he absolutely smashed it! The person who really got me thinking the most was Siri Børsum, VP at Huawei. Total legend.

Børsum spoke about the importance of financial literacy with so much clarity and sense, that she developed a kind of messiah vibe. “Financial health is as important as physical health“, she lamented. “If you’re comfortable with your finances, you’ll most likely be a lot happier and healthier“. I totally get where she was going with that. It all bleeds into each other. You can’t be healthy if you’re super stressed etc. I also loved the way she spoke about the business-critical need for more diversity. YES BØRSUM!

Because “embedded finance” means “integrated into everything”, right? Kind of. Not just tech platforms. Not just online companies. But into our lives. And if finance is embedded into our lives, then this means more than just our bank accounts. Questions about financial literacy, wellness and inclusivity somehow neatly slot into the embedded finance conversation. Questions around classism and living standards too.

Could embedded finance help solve the housing crisis?

Changing lives with embedded finance may sound a bit fluffy. But it has some real roots. Take an extreme example, a one-day mortgage application. That was the hypothetical focus of discussion at another panel I attended.

To a big bunch of lending experts, Ali Paterson, Editor of Fintech Finance, asked the question, “Why can’t [getting a mortgage] be done in a day?“.

“It’s these 70s, 80s, – at best 90s – systems“, said an exasperated Richard Davies from Allica Bank. All the panellists agreed that mortgages could be done so much faster with tech that currently exists…. But it’s not being leveraged by today’s incumbents. Many of whom take upwards of six weeks to make a decision.

What’s more, according to Davies, embedded finance and the data that comes with it could be used to develop better “products that really fit“.

“Banks don’t serve the whole market“, agreed Marita Cavalcanti, Chief Financial Officer at Proportunity (amazing company name!).

So who could benefit from new embedded finance mortgage products? Well, single parents, freelancers like me, jobseekers … all the zillions of people who do not have 10% of the insanely expensive property they wish to buy. And THAT’S what would make a huge impact. As Cameron Orcutt, founder of Onladder advocates, “We can’t leave people out in the cold“.

So, could embedded finance help to even-out some of the great wealth injustices of our time? It depends on the customer, but I think that with the right support, embedded finance can spread financial democracy around the world.

“Frustrating” regulations (or lack of them) around data

Ohh… I spoke too soon. I meant, in parts of the world where the regulators are onboard. Totally different thing.

To find out more about where we are with that, I checked into the The Regulatory Review panel, hosted by Fintech Finance’s Deputy Editor, Douglas Mackenzie and listened to the experts rant it all out.

It’s all very polite and cordial in these regulatory meetings. But hidden behind the calm exterior, you could see that the experts were concerned about the way things are heading. The words “frustrating” and “damaged” came up a lot.

“Many of the regulations around data are not stable enough to be built on“, exclaimed Gavin Littlejohn, Chair of FDATA Global, in a rare outburst of passion… shattering the formal politeness. “Only 25% of the APIs in the EU are worth a damn!“

But that’s the thing with regulations, isn’t it? It’s very hard to be proactive, rather than reactive. And often the regulators are one step behind. Both experts praised Brazil as a strong hub of data innovation, and that makes me think even more that data and embedded finance is shifting the wealth dynamics. Will we still be able to call some countries “developing” when they have a more advanced embedded finance system than us? How will the world change when the unbanked suddenly have access to accounts, savings and online spending? We have an opportunity here to make things better.

My big takeaway

I’m going to write this blog the wrong way round, and end with a definition of embedded finance. It’s when financial processes which could usually only be done by a bank are integrated into other services. Like paying for an Uber. Or getting insurance at the online checkout.

But it’s a lot more than that really. It’s about collecting and harvesting data in a safe and ethical way. It’s about using technology to benefit underserved and unbanked communities. It’s about being inclusive.

We have a big challenge ahead of us. We must use embedded finance to make the world a better place. At every panel (I went to six), I asked the speakers how they are using embedded finance to reduce carbon emissions. The answers were pretty varied. Some people had clearly thought about it a lot. Others not so much. But for me, these are the only questions we should be asking.

At every point and every juncture, fintechs must ask themselves, “How is this making the world a better place?”. Because, otherwise, what is the point of embedded finance? Why bother?

Right now, we have a real chance on our hands to use finance for good. We have to make sure that it’s used by the right people, for the right things. Otherwise it just becomes another profit-over-planet nightmare that needs disrupting all over again.

A big thank you to all the organisers of Fintech Talents 2021! I’ll be thinking about embedded finance all the way up to the 2022 event! 🚀

*Well, exploded is a strong word, it was more of a conversational tone really. But it felt very explosive!